Even When Traveling Through a Storm, Some Paths are More Pleasant than Others

December 30, 2022

It can be very expensive to try to convince the markets you are right.

—Ed Seykota

We can’t control the market. This should be self-evident, but it doesn’t always feel that way.

How many times are you convinced that the market will do X, only to have it do Y?

The cost of this inherent flaw in our DNA is not just to our egos. The future financial well-being of real people is at stake.

Many of those real people, possibly including you and your clients, likely did not expect the market environment we saw in 2022. It also probably didn’t fit nicely within a financial plan.

As a systematic investing firm, Blueprint Investment Partners and our investment process has no expectations. In fact, our only expectation is that our process will be executed with intense discipline and focus.

This doesn’t mean that we like bear markets. The reality is that our team, as humans, are just as prone to emotional biases about the market as anyone. Fortunately, our systematic investment process is not.

In this month’s Co-Founders’ Note, we discuss our systematic investing process in the context of 2022’s market environment. While the short-term destination is out of our hands, we think we have more control over the long-term outcome and the ride to get there. In our estimation, utilizing a rules-based process provides financial advisors and their clients with a more pleasant experience and path.

But first, here’s a summary of our take on what transpired in the markets in December.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

In last month’s Co-Founders’ Note we cautioned that despite increases off the October low, U.S. equities had not yet broken the declining trendline of 2022, and thus it would be difficult to classify any rally as significant. Indeed, the promise of a prolonged Santa Claus rally was dashed after November’s strong close resulted in yet another failed high in December. The December decline is enough to send U.S. equities back into a downtrend in the intermediate timeframe, joining the long-term downtrend. Our portfolios will move further underweight in response.

International equities also declined in December, but developed markets managed to maintain their intermediate-term uptrend for now. Thus, exposure in our portfolios will not change.

After flirting with a trend change, emerging markets continued to experience downtrends, which means our portfolios will remain at or near their minimum allocation.

Our portfolios continue to hold minimum allocations to real estate securities, as they continue to be weaker than their equity counterparts both domestically and internationally. Until some light is visible at the end of the rate-hike tunnel, it will be a challenge for this asset class to produce meaningful positive attribution.

Fixed Income & Alts

Many bond instruments briefly produced their first uptrends in 2022 over relatively shorter timeframes. However, that quickly faded with declines forcing downtrends as we end the year. International bonds continue to maintain an intermediate-term uptrend but will remain underweight in the portfolios given their long-term downtrend.

Gold continues its steady climb from early November lows and is at its highest level since around summertime. Last month we increased exposure due to the emergence of an intermediate-term uptrend, which continued in December. If the trend continues, gold is on pace for a long-term uptrend at some point in January. For now, exposure remains unchanged and underweight but poised to increase further.

Sourcing for this section: Barchart.com, Total Stock Market ETF Vanguard (VTI), 12/31/2021 to 12/30/2022; Barchart.com, S&P 500 SPDR (SPY), 12/31/2021 to 12/30/2022; and Barchart.com, Gold Trust Ishares (IAU), 9/30/2022 to 12/30/2022

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Declining Population Growth: America’s population grew 0.4% this year, per Census Bureau figures released this month. The latest data shows a continuing trend of historically slow growth, which adds pressure to a tight labor market. The U.S. added 1.3 million people in the year that ended July 1 for a total population of 333.3 million. That includes 245,000 more births than deaths, a surplus that has long supplied much of the nation’s growth. The other component is net migration, which measures people moving in and out of the country. This figure grew by 1 million. Long-term economic growth is heavily dependent on population growth.

Declining Spending: Consumer spending and business demand softened late this year, while inflation eased, indicating a slowing U.S. economy. Personal spending increased 0.1% in November from the prior month, which is a significant pullback from the 0.9% increase in October. Households increased spending on services while decreasing on goods. The spending was flat when adjusted for inflation.

Declining Home Sales: Existing-home sales in the U.S. slid in November for a 10th straight month. The latest data extends a record streak of declines. Sales of previously owned homes declined 7.7% in November from the prior month, which is a 35.4% decline from a year prior. This streak of declines is the longest on record in data that goes back to 1999. The Federal Reserve has raised rates seven times this year to combat high inflation by slowing spending, hiring, and investment. As a result, mortgage rates have climbed to above 7% in early November from 3.1% at the end of 2021.

Sourcing for this section: The Wall Street Journal, “U.S. Population Growth Remains Sluggish Despite Uptick This Year,” 12/22/2022; The Wall Street Journal, “Consumer Spending Tapered Off Ahead of the Holidays,” 12/23/2022; and The Wall Street Journal, “U.S. Home Sales Post Record 10th Straight Month of Declines,” 12/21/2022

If Trend Following Is So Great, Why Doesn’t Everyone Do It?

You do not rise to the level of your goals. You fall to the level of your systems.

—James Clear

Most of the time we use this section of the Co-Founders’ Note to explain current events in the financial markets in the context of how a systematic investing approach can benefit financial advisors in real time. However, approximately once a year we use it to remind our readers about the challenges of a systematic investing process. We do this for two reasons:

- Credibility and trust are arguably the most important currency we hold. Regardless of their merits, all investment processes have imperfections and, at times, cause their investors and creators to question their conviction. Acknowledging that reality as part of the journey to successful implementation is critical, in our view.

- The most common question we receive when sharing our process with advisors is, “If it’s so great, why doesn’t everyone do it?” Regardless of the question’s underlying motives, it demands a response that we are happy to provide. See, long ago we decided it is better to go deep than wide; we aim to serve a tight-knit group of advisor partners who embrace our process rather than a large group of the only mildly-committed. Consequently, answering this question becomes a litmus test for whether an advisor can be committed enough to maximize the long-term benefits of a systematic investing process.

If someone were looking for a period to define why our style of systematic investing can at times challenge your discipline, 2022 might be a good example:

- Closing 2021 at all-time highs in U.S. equities meant maximum exposure for our strategies entering the new year.

- As is often the case, when markets subsequently declined, our strategies participated in stage 1 of that decline before cutting exposure.

- From the middle of the first quarter until the fourth quarter, the strategies spent their time protecting capital and outperforming their respective benchmarks.

- The fourth quarter brought a rally from lows in October, followed by another decline in December. This meant our strategies went from being fully defensive to having marginally higher equity exposure during the quarter. The end result was that calendar year absolute returns generally exceeded benchmarks but not by the margins seen at the Q3 lows in equities.

A skeptic might look at the 2022 performance and ask, “What’s the big deal about trend following?”

Looking at one snapshot in time, they might have an argument. But that’s a little like judging a painting that is still in progress.

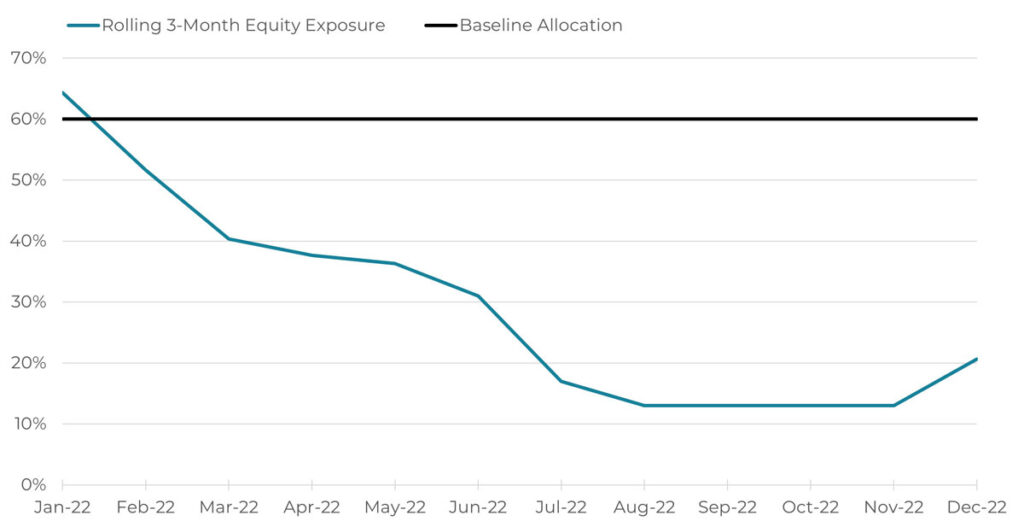

A more granular view of 2022 reveals that a trend following process, even one with a long bias like ours, spent much of the year outperforming benchmarks – and by significant margins at times. Consider the following graph, which displays the rolling 3-month total equity exposure for the Blueprint Tactical Balanced Strategy against its baseline allocation.

Tactical Balanced Strategy: Rolling Equity Exposure vs. Baseline Allocation

Source: Blueprint Investment Partners, 1/1/2022 to 12/31/2022

Once downtrends emerged as a result of January, the Strategy steadily reduced equity exposure and spent almost the entire year well below its baseline allocation.

Even in a year when the destination wasn’t great (i.e., negative returns), the ride was much better for advisors and their clients than a traditional approach, in our view.

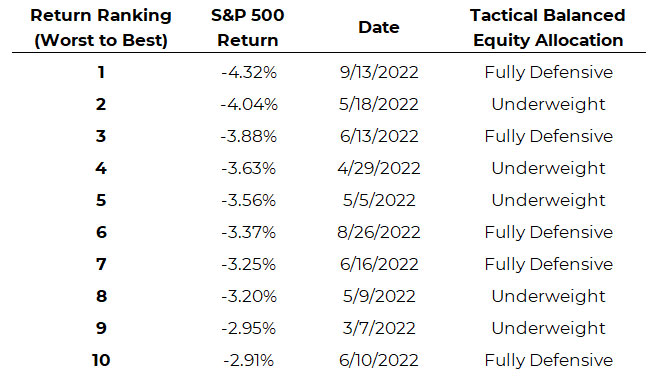

The data below demonstrate “the ride” in terms of the relative equity exposure of the Tactical Balanced Strategy during the S&P 500’s worst 10 performance days of 2022.

Tactical Balanced Strategy: Positioning During S&P 500’s Worst 10 Days of 2022

Source: ICE and Blueprint Investment Partners, 1/3/2022 to 12/28/2022

As we have written before, the worst days in equities tend to occur after downtrends emerge. And 2022 was no exception. As we’d expect in these conditions, the 10 worst days coincided with our strategies being underweight equity exposure or fully defensive.

Underweight and defensive positioning helped lower the volatility and drawdown levels in our portfolios, and there was the added benefit of our advisor partners being able to communicate plans and actions to their clients at every turn. We believe the ability to take decisive action and communicate the rationale clearly is a tremendous benefit of our approach because it can put clients at more ease than simply repeating the mantra of, “Hang in there! The market always comes back!”

And this approach reinforces what matters most to us at Blueprint Investment Partners: serving our advisor partners. Without you, our partners, we wouldn’t get to do what we enjoy the most. So, with that in mind, we are invigorated and excited about what 2023 has in store. We will continue to execute our strategies and look for innovative ways to serve our advisors better.

Sourcing for this section: Barchart.com, Total Stock Market ETF Vanguard (VTI), 5/24/2021 to 12/31/2021; Barchart.com, Total Stock Market ETF Vanguard (VTI), 10/1/2022 to 12/30/2022; and Barchart.com, S&P 500 SPDR (SPY), 10/1/2022 to 12/30/2022

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process