Which is Better: Consistently Good or Occasionally Great?

November 30, 2022

The first rule of compounding: Never interrupt it unnecessarily.

—Charlie Munger

Compounding. It’s all around us and in virtually everything we do. It’s a word that generally everyone knows but the power and significance get lost on many.

Whether you’re trying to lose weight, train for a marathon, learn a new language, or achieve a financial goal, harnessing the power of compounding is critical because each small decision has large implications on the outcome.

To Charlie’s point above, in our view there are two ways to interrupt compounding: allowing small losses to turn into big losses and not allowing small profits to turn into big profits. Yes, this is trend following 101, but simple, daily decisions made with the intention of preventing either of those scenarios can have massive future implications on long-term compounding.

In this month’s Co-Founders’ Note, we discuss compounding through the lens of being consistently good versus occasionally great. Our goal at Blueprint Investment Partners is to be consistently good because we think maintaining discipline at every turn and delivering a reliable systematic investing process leads to predictable, satisfactory long-term results.

But first, here’s a summary of our take on what transpired in the markets in November.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

The recent increase in U.S. equity prices since the last low October 13 continued in November and is enough to create an intermediate-term uptrend for the first time since August. It will be the first time since March that we’ve seen positive trends at month-end. As a result, all Blueprint portfolios will experience an increase in exposure. While still underweight versus our baseline allocation, the exposure increase should be enough to allow positive returns should the year close strong. A word of caution is warranted however, as U.S. equities have still been unable to break the trendline of lower highs in 2022. Until that occurs it is difficult to call the current rally significant.

International equities, particularly developed markets, have also increased since their last low in the first half of October. The increase has been significant enough to create an intermediate-term uptrend, but it’s also arguable whether it breaks the declining trendline that has existed for all of 2022. On a longer-term basis, when juxtaposed with U.S. equities, this is a considerable development for foreign equities. The same cannot be said for emerging markets, as they continue to experience downtrends. Overall, our exposure to international equities will increase but only to developed markets.

While real estate securities experienced gains in November, they are not enough to generate a meaningful uptrend. Consequently, Blueprint portfolios remain at their minimum exposure to this asset class. Until some light is visible at the end of the rate hike tunnel, it will be a challenge for this asset class to produce meaningful alpha.

Fixed Income & Alts

Let’s face it, fixed income assets have been a dumpster fire in 2022. That said, there were some interesting developments in November from a trend perspective. For example, international bonds are on pace to experience their first end-of-month intermediate-term uptrend in almost a year. All U.S. bond segments remain in downtrends across both timeframes, but they are close to producing uptrends (as they have been all year).

While 2022 has undoubtedly been a disappointing year for gold given the tailwinds of inflation and war, gold did manage to close the month with an intermediate-term uptrend. As a result, Blueprint portfolios will increase exposure. Some work needs to be done to create a long-term uptrend, but after making a new low earlier in November, recent progress is promising.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Slowing Down: After an aggressive path of rate increases this year, Federal Reserve officials are starting to consider how the economy is reacting to more restrictive monetary policy. The Fed raised rates by 0.75% at each of the last four meetings in an attempt to markedly slow down inflation. The Fed is now signaling that they will only raise rates 0.50% at the next meeting and may lower to the more traditional 0.25% raises after that.

Flying Inverted: Yields on longer-term U.S. Treasuries have fallen even further below those on short-term bonds. The difference is greater than at any time in decades, a sign that investors think the Federal Reserve is close to slowing or pausing rate hikes. An inverted yield curve is often the market’s way of indicating that a recession is looming. Typically, that is because market participants think the Fed will need to slash borrowing costs to revive a faltering economy.

The Well is Dry: The huge pile of cash and deposit savings that consumers built up during the COVID-19 pandemic is shrinking. Economists expect it will run out before the end of next year. Government stimulus and reduced spending opportunities allowed households to accumulate a large amount of excess savings, of which $1.2 trillion to $1.8 trillion remain. This savings buffer helped Americans keep spending elevated despite historically high inflation and rapidly rising interest rates. As the savings dwindle, signs of financial distress could reappear, such as rising default rates on loans.

Consistently Good vs. Occasionally Great

It’s more important to be consistently good than occasionally great.

—Jeff Cunningham, marathon/distance running coach

If you are like us, then as you get older being healthy is becoming more important. Monitoring diet closely, strength training, and running have all become normal routines for many of us at Blueprint. As these lifestyles are being incorporated, we cannot help but notice the parallels between health/fitness and our systematic investing process for our risk-managed portfolios.

The quote above could just as easily represent the core tenets of a systematic, trend-following investment strategy as it does distance running:

- Understanding the goal and key constraints

- Focusing on the process rather than short-term outcomes

- Realizing that over time things should play out in our favor if we stay consistent

This is what our investment process is all about.

One of the primary reasons we are so passionate about this philosophy is how strongly we feel it benefits financial advisors. An advisor who can build a practice that consistently delivers strong results and service can become an enormously valuable institution that helps many clients and families. However, an inconsistently great advisor can suffer from fits and starts, ultimately never living up to their potential. What a tragedy if the latter occurs when the former is so attainable.

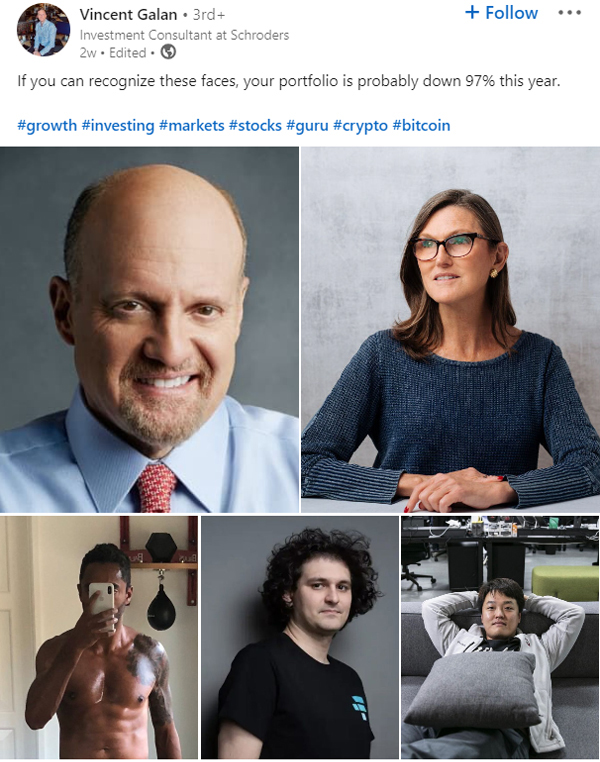

Vincent Galan, an Investment Consultant at Schroeders, recently posted the image you see here on LinkedIn. It shows pictures of occasionally great investors/entrepreneurs like Jim Cramer, Cathie Wood, and Sam Bankman-Fried with a clever caption: “If you recognize these faces, your portfolio is probably down 97% this year.” Certainly, these folks have made themselves rich and famous, but what have they done for advisors who have relied too heavily on their products/thoughts?

Vincent Galan, an Investment Consultant at Schroeders, recently posted the image you see here on LinkedIn. It shows pictures of occasionally great investors/entrepreneurs like Jim Cramer, Cathie Wood, and Sam Bankman-Fried with a clever caption: “If you recognize these faces, your portfolio is probably down 97% this year.” Certainly, these folks have made themselves rich and famous, but what have they done for advisors who have relied too heavily on their products/thoughts?

Perhaps the primary obstacle to being consistently good is ego. In distance running, there is a temptation to go faster than is appropriate for a training session. In investing, there is a desire to make a prediction about how something will increase in value in order to appear smart or prescient.

The worst thing that can happen for the ego is sometimes these predictions come true, which can encourage the investor to continue making projections about things that are essentially unknowable. Moreover, for all those times when the ego’s gamble pays off, there’s often at least one loser that more than offsets the gain. But the losses are rarely talked about as transparently as the gains, which creates a distorted perception of reality.

Our research indicates it is better to avoid these predictions and instead follow systematic investing rules to stay focused on process.

In our view, the incredible thing about being consistently good is that if you can manage it for a long enough period, you often accomplish something truly great. For example, consistently beating a benchmark in a way that is behaviorally- and tax-friendly for clients allows them to maximize their financial potential. Coupling that with a robust process for planning and managing relationships allows an advisor to build a tremendous business.

So, as we enter the final month of 2022, that is what we continue to do: focus on what we can control, show up, and follow the process. It has treated us and our partnering advisors well, and we anticipate it will continue as we prepare for 2023.

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process