Trends With Benefits

Something that unites almost every asset manager that believes it uses a disciplined, repeatable investment process is our annoyance with performance chasing. The root of this frustration is how performance becomes a shiny object that can distract some investors, and even some financial advisors. It can be particularly difficult to look away from the shine during prolonged bull markets, when human nature makes investors feel more invincible.

Here’s an ironic twist: The other day I realized that Blueprint Investment Partners, as a trend follower, actually has plenty in common with performance chasers. Except for one (gigantic) difference.

We’re All Reacting to Price

Trend followers use an asset’s price as the primary input for making decisions about whether to buy, sell, or hold.

Performance chasers also react to price. If the price is rising, they’re rushing to buy. If it’s falling, they can’t sell quick enough. In recent memory, is there a better example of this style of investing than GameStop? It was well under $5 through most of 2020 but exploded to peak at nearly $500 in 2021, fueled by and fueling additional frenzied buying. A slightly calmer mania marked the ride back down.

The story played out similarly for other meme stocks, which experienced buying and selling that seemed primarily based on behavior of the herd, r/WallStreetBets chatter, and constant attention from mainstream media.

Trend followers see that activity, then plug their ears and cover their eyes to it. Because there’s a major, major difference in HOW trend followers and performance chasers react to price. In a word: Process.

Systematic Investing is Incompatible with Emotional Responses

Disciplined trend followers like Blueprint Investment Partners use a systematic investing process that strives to be repeatable and predictable. The process is quantitative. It’s rooted in data and data only. Period.

Our systematic investing process gives no credence to gut feelings. It doesn’t take into consideration the sentiment of financial pundits, and it doesn’t care what the crowd is doing. Instead, it’s simply driven by these transparent rules:

- If the 10-day exponential moving average (EMA) is above the 100-day EMA, it’s an intermediate-term uptrend signal, and we buy or hold. If it’s below, it’s an intermediate-term downtrend signal, and we sell.

- Same thing, but with the 50-day and 200-day EMA to determine the direction of the long-term trend.

The process can be applied to almost any investment vehicle. In our portfolios, we typically apply it to both ETFs and individual stocks – INCLUDING meme stocks!

No really, since 2020 Blueprint portfolios have held several names that have become meme stocks.

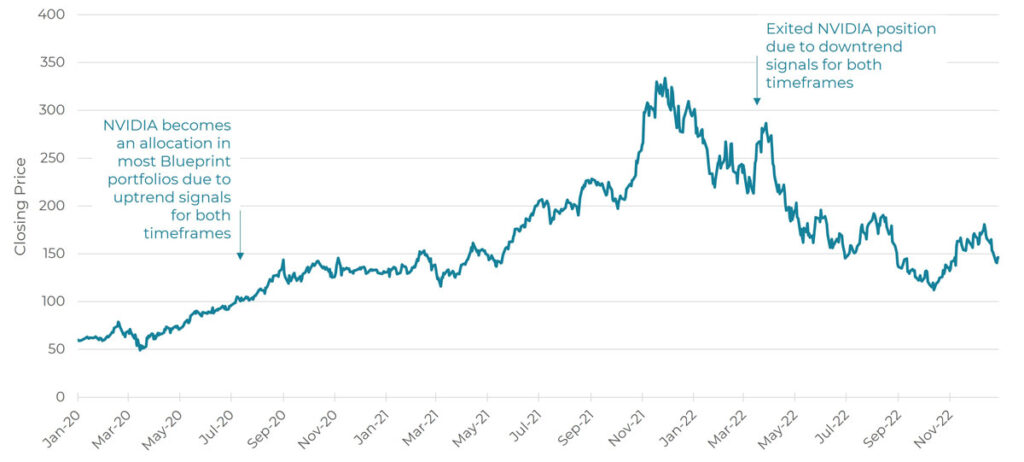

We can use NVIDIA as an example. Most of our portfolios had an allocation to it by July 2020 because our trend systems were signaling uptrends. We exited the position early in 2022, prior to the stock’s plummet, because our process was signaling downtrends. We were not making a prediction about the future direction of the stock; we were simply following our process as it reacted to price data.

NVIDIA Price Data 2000 to 2022

The scale of NVIDIA’s move and the duration of the uptrends allowed trend followers like Blueprint Investment Partners to apply a pre-defined process to determine when to buy and sell. And that’s the point: Trend following removes emotions and noise, seeking to capture the core part of upward moves. The bulk of it, though not the entire move.

In our opinion, that’s a small price to pay in exchange for managing risk during drawdowns.

Moreover, because systematic investing processes strive to be repeatable and predictable, both financial advisors and their clients can sleep easier at night knowing what they can expect from their portfolios.

Even Famous Money Managers Sound a Lot Like Trend Followers

I started this blog by recognizing the irony in how Blueprint Investment Partners and performance chasers have common ground because of our mutual focus on price. Similarly amusing to me is how some of the most well-respected money managers – ones who almost never get mentioned in the same breath as “trend follower” – have deeply held beliefs that overlap with the core tenets of trend following.

An example is Howard Marks, the esteemed Oaktree Capital money manager whose writings are a must-read for Warren Buffett. Howard has written about how conventional thinking and taking the same actions as the crowd are incompatible with a “timelessly successful investing approach.”

In our view, the “conventional thinking” he talks about is chasing the shiny object. The “timelessly successful investing approach” is following consistent investing rules, even when it feels uncomfortable or the financial news is saying it’s the wrong move – that is a textbook definition of disciplined trend following.

Mike Carlone

Let's Talk

If you’d like to learn more about the Blueprint Investment Partners approach to trend following