Market Predictions – Why Bother?

Well, here we are again.

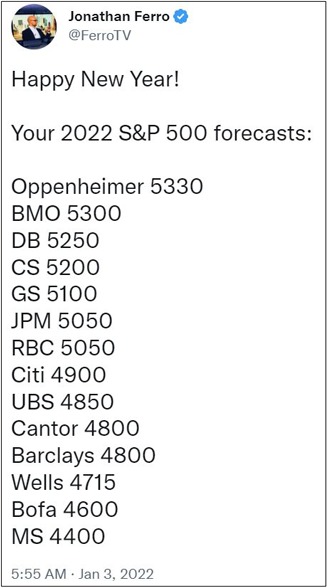

It’s that time of year when many asset managers like to make predictions about the year ahead, while Blueprint Investment Partners calls attention to the foolishness of that exercise. As evidence, I give you this January 2022 tweet from Bloomberg media personality Jonathan Ferro, who recaps how 14 leading financial firms foresaw the S&P 500 ending 2022.

Their guesses lend credence to my assertion that one of the only annual market predictions worth making is this: Following a consistent, disciplined investing process will lead to better outcomes than trusting the predictions of financial “experts.”

I mean, how much of an “expert” can you be if your prediction for the S&P 500 in 2022 is likely to miss the mark by 20-30%? It makes you wonder if anyone over there at overly optimistic Oppenheimer even realizes that what happens in the stock market dramatically impacts everyday investors and the financial advisors who, especially in a year like 2022, are challenged to keep their clients anchored to their financial plans.

Predictions Are ‘The Fun Parent’ of Investing

On the one hand, I understand the appeal of investing predictions. They’re fun. They’re fluffy. They give a sense of security (so long as you can overlook that it’s a false sense).

On the other hand, you have investing process. It’s rather dull by comparison due to its steadiness. Focusing on process means admitting you are clueless about what the market is going to do next. And yet, that’s an ironically reassuring realization for the asset managers and financial advisors who understand the value of consistency and discipline.

A reliable process can provide a more tangible sense of security than predictions because even if you don’t know WHAT will happen in the future, you can trust that your investment process has a plan for HOW to respond.

What Happens When The Sizzle Fizzles?

The value of having a plan and consistently following it shows up throughout life: losing weight, training for a marathon, learning a new language, as well as achieving a financial goal.

However, ego can be a major obstacle for consistency. In distance running, there is a temptation to go faster than is appropriate for a training session. In investing, there is incentive to make a prediction about how something will increase in value to appear smart or prescient. Our 24-hour-news-cycle and trending-on-Twitter world often rewards predictions with attention.

Predictions have sizzle, as do the people willing to espouse them.

For those who live by the sizzle, it’s possible the worst thing that can happen is for their predictions to sometimes come true, because it can inflate their ego and encourage them to continue making projections about things that are essentially unknowable. Moreover, for all those times when the ego’s gamble pays off, there’s often at least one loser that more than offsets the gain. But the losses are rarely talked about as transparently as the gains, which creates a distorted perception of reality.

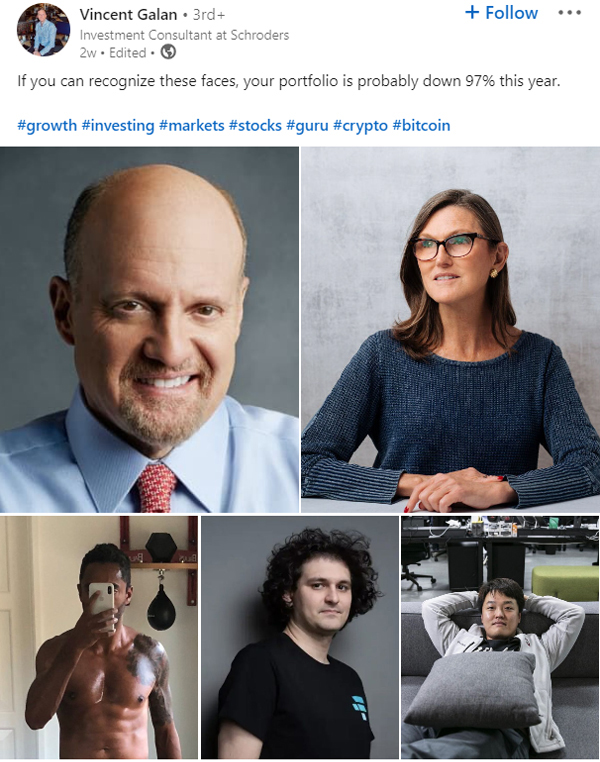

I thought of this when a colleague shared with me the LinkedIn post you see in the screenshot here. It shows pictures of some of the most popular prognosticators of our time, like Jim Cramer, Cathie Wood, and Sam Bankman-Fried. The caption is clever, in my view: “If you recognize these faces, your portfolio is probably down 97% this year.” Certainly these folks have made themselves rich and famous by spewing predictions, but what have they done for advisors who have relied too heavily on their products or thoughts?

A historic 13-year bull market helped obscure the folly of sizzle, until 2022 ushered in an unmasking.

Consistently Good (Not Occasionally Great) Asset Management

Being consistent by following the same investing rules month after month, year after year rarely leads to headline-grabbing results. But it usually leads to reliable, satisfactory long-term results and a smoother ride for clients.

One of the primary reasons Blueprint Investment Partners is so passionate about this philosophy is because of how strongly we believe it benefits financial advisors. An advisor who builds a practice that consistently delivers strong results and service can become an enormously valuable institution. However, an occasionally great advisor can suffer from fits and starts, ultimately never living up to their potential. What a shame if the latter occurs when the former is, in my view, so attainable.

The incredible thing about being consistently good is that if you can manage it for a long enough period, you often accomplish something truly great. For example, consistently beating a benchmark in a way that is behaviorally- and tax-friendly for clients allows them to maximize their financial potential. Coupling that with a robust process for financial planning and managing relationships allows an advisor to build a tremendous business.

So, as we roll into a new year, that is what Blueprint Investment Partners will continue to do: focus on what we can control, show up, and follow our systematic investing process. It has treated us and our partnering advisors well, and we anticipate it will continue in the year ahead.

Mike Carlone

Let's Talk

If you’d like to discuss our investing process