Dynamic Separately Managed Account Strategies

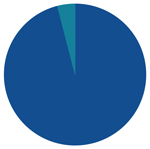

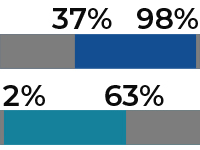

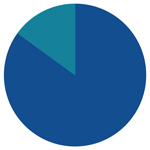

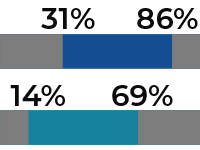

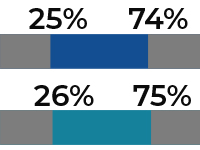

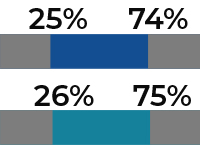

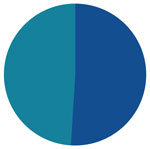

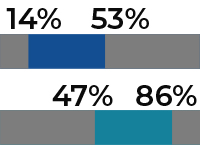

50% of the Portfolio Is Tactically Managed

Risk Budget

Tactical

Intermediate-Term Trend

Tactical

Long-Term Trend

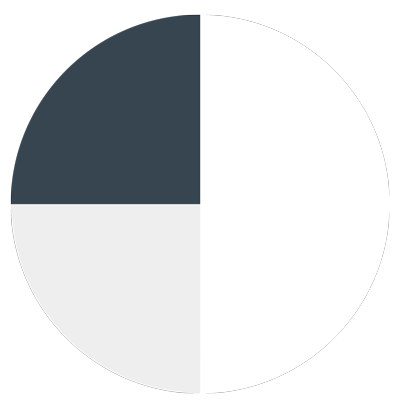

Strategic

Bought and Held

Within the tactical portion of the portfolio:

- Decision making is split between two timeframes. Time diversification makes our strategies naturally tax-friendly.

- Asset allocation changes are made monthly. We use our systematic investing process to answer all questions about what and how much to transact. This process is applied to both ETFs and individual stocks.

Let's Talk

If you’d like to learn more about a Blueprint Investment Partners Dynamic Strategy