Managing Risk During Market Drawdowns

Market drawdowns aren’t in question. They happen.

The real question is about how financial advisors will preserve capital and keep clients anchored to their financial plans during emotionally charged environments.

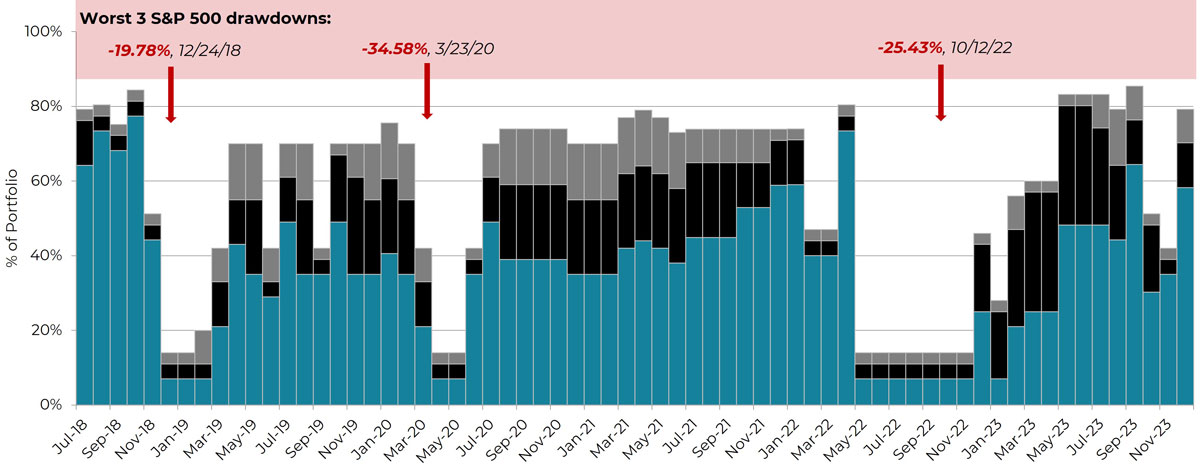

A risk-managed, all-weather portfolio has a plan for how to handle various market conditions before they occur, including drawdown environments. In times of falling markets, the systematic investing process helps the portfolio allocate away from downtrending asset classes.

Systematic Investing Process at Work During Market Drawdowns

Total Equity Exposure – Blueprint Tactical Growth Strategy (7/1/2018 to 12/31/2023)

Drawdowns source: ICE

5 Primary Attributes Blueprint Portfolios

Global Asset Allocation

Portfolio diversification across eight major global asset classes in a single investment vehicle

Rules-Based Process Optimized for Behavioral Finance

Systematic investing process answers questions about what, when, and how much to buy and sell – repeatable rules that can help maintain discipline during prolonged market volatility by leaving no room for emotional decision-making amidst euphoria or fear

Dynamic Adjustments in Response to Market Changes

Asset allocation naturally adapts to market conditions – portfolio can look quite different depending on the environment (e.g., when there are uptrends/downtrends in an asset class, interest rates change, volatility arises, or inflation/deflation occurs)

Focus on Managing Downside Risk

Constructed to manage risk during bear markets and severe drawdowns (like 2022 and the Coronacrash of March 2020), but doesn’t need to go completely “risk off” amidst less significant pullbacks (especially those that affect only select asset classes, not the whole financial system)

Ongoing Tax-Loss Harvesting

Tax-friendly portfolio is possible by using a blend of timeframes – this time diversification allows losing positions to be sold quickly, but gains can be held as long as uptrends persist

Monthly Asset Allocation Update

Summary of current positioning

Let's Talk

If you’d like to learn more about our risk-managed, global asset allocation strategies