Anatomy Of A Bear Market

There are numerous examples of words and phrases entering the lexicon, providing deep meaning for many years, but over time and with frequent use losing significance among the masses. The word or phrase itself didn’t change, but the meaning was diluted by changing circumstances.

I worry that “downside protection” has run through the watering-down process.

During and immediately after the Financial Crisis – which coincided with origins of the investment philosophy Blueprint Investment Partners is built upon – there was almost universal agreement on what the phrase meant. It was the avoidance of catastrophic loss from a bear market so terrifying it could weaken the knees of the most experienced financial professionals.

However, a virtually uninterrupted bull market in equities during the last 10+ years has, in our opinion, changed how this phrase is defined. The definition has expanded to include any correction in the markets. The creep in definition has important consequences, not only for us but also for financial advisors and investors, because not every decline in the market should be viewed and reacted to in the same way.

Preserving Compounding Is As Important As Ever

For 15 years, the phrase “downside protection” has been powerful in the investment philosophy promoted by my fellow Co-Founder Jon Robinson and I. So, before I proceed, let me make two things clear:

- Preserving compounding through some sort of downside protection (however your financial advisory practice defines it) is as important as ever.

- Blueprint Investment Partners continues to place the same emphasis on preserving compounding as always. Our process and mindset is not changing. What IS up for change is the degree of nuance in HOW we communicate, which is arguably more important in a realm where relationships and communication are paramount to advisor and client success.

Classifying Declines into 3 Categories (Anatomy of a Bear)

We have all been told from a young age by parents, grandparents, or teachers that nothing in life is free. Tradeoffs exist for everything, from where to live to small things like our brand of shampoo. The same tradeoffs exist for investments. Seek returns at the cost of risk and vice versa.

When it comes to protecting against declines in client portfolios, financial advisors must decide how much of a price decrease their clients are willing to experience before exiting or reducing exposure to the market in question.

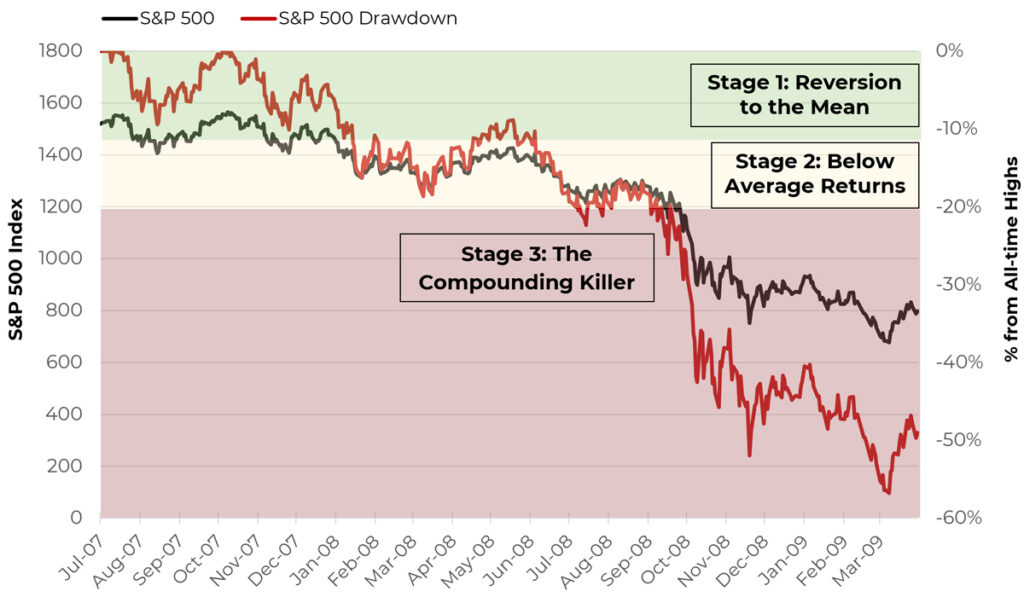

We have found it is helpful to classify declines in three different categories, since not all declines are equal. These categorizations help in better understanding where risks lie, where the relationship between return-seeking and risk-avoiding is optimal, and the level of downside protection that’s appropriate. We consider these pieces to be the anatomy of a bear market:

- Stage 1: Reversion to the mean

- Stage 2: Below average returns

- Stage 3: The compounding killer

The reference point for each stage of the decline is the distance from the previous all-time high. Here’s how each stage maps to the most recent major market drawdown:

Anatomy of a Bear Market

S&P 500 Index: July 2007 to March 2009

Coming to Terms with Discomfort While Avoiding Catastrophic Pain

Again, the first principle is that not all declines are equal. If an investment has produced above-average returns for a meaningful amount of time and then declines to its long-term average, it may be discomforting, but this alone should not always be cause for concern or immediate action. However, if an investment declines by the same amount after already suffering through a 50% drop, it’s a different story. Clearly some declines are acceptable if any meaningful return is to be attained.

We hope readers will agree that some declines are natural, expected, and best endured (stage 1). Others represent an opportunity to reduce exposure to tilt long-term compounding in a client’s favor (stage 2), and still others are to be avoided at all costs (stage 3). Having and understanding of behavioral finance and how each stage is different can help:

- Increase the chances an advisor will be able to keep a client’s financial plan in alignment with an investment strategy that can deliver on that plan

- Reduce the impact of emotions, which in the best-case scenario only shows up as a client feeling discomfort when riding through a decline, but in the worst case causes behavior that detracts from long-term performance

Blueprint Investment Partners builds and executes our systematic investing strategies with these stages in mind, and our process reacts differently at each. In a blog we’ll post next week, we’ll dig deeper into each stage to:

- Further define its attributes

- Explain how a systematic investing process like ours reacts

- Reinforce the importance of REAL downside protection

Brandon Langley

Let's Talk

If you’d like to learn more about our approach to managing through bear markets