Predictions: The Ugly Sweater Of Financial Markets

The months of November, December, and January are chock full of traditions. Family dinners, presents, tree-cutting journeys, ugly sweater parties, and matching pajamas (don’t ask) are all emblematic of this time of year.

In the financial markets, the equivalent to the ugly sweater party is the making of market predictions for the year ahead. Sure, it’s fun, they’re cute, and they grab attention. But ultimately, they are useless and thus a waste of time. (Yes, I’m aware I sound like Scrooge right now.)

One need look no further than 2024 to be reminded (once again) of the futility of market predictions. By some accounts, the average of 2024 forecasts had the S&P 500 Index closing at 4,861, yet in reality the year closed with the benchmark index closing higher than 5,880 – that’s an error of about 21%…on average. Yikes.

In this century, the highest annual return for the S&P 500 was 32.4% in 2013. The roughly 25% increase for last year puts 2024 in seventh position. This interactive chart highlights these data points and is an interesting way to consider annual returns in the context of a bigger picture.

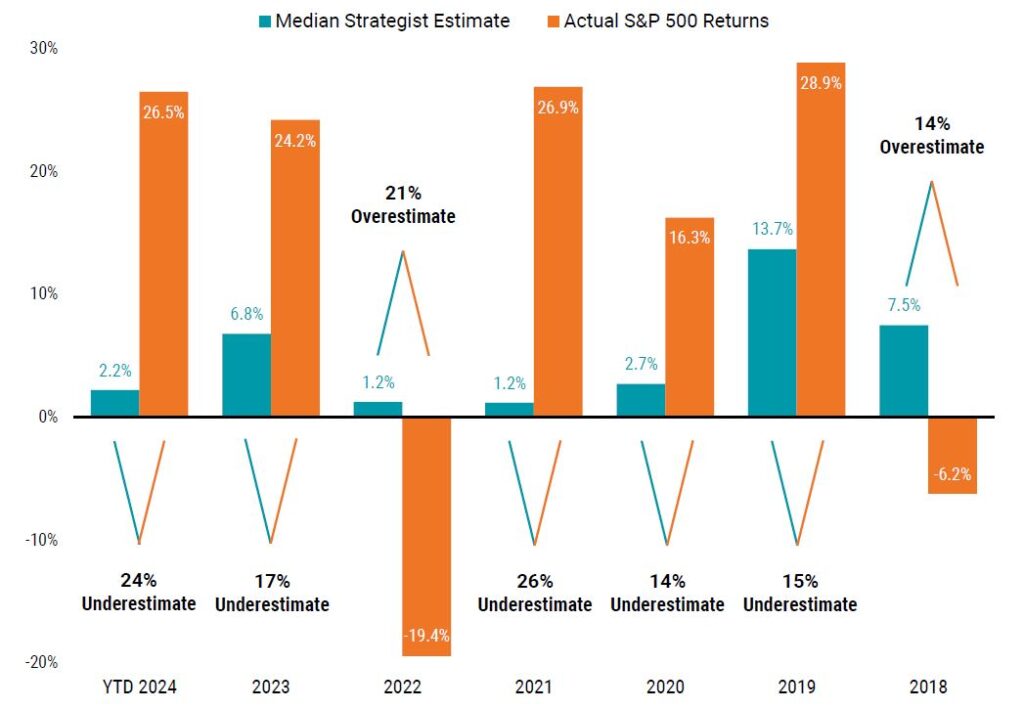

Just in case anyone is tempted to chalk up the 2024 prediction misses by financial services “experts” as simply a bad year for forecasting, I would suggest you consider the following chart from Avantis Investors, which highlights how consensus estimates have not been within 10% of the actual return during the last seven years, from 2018 to 2024. In fact, the closest the predictions have come was 14% in both 2018 and 2020, when the S&P 500 fell 6.2% on a predicted rise of 7.5% (2018) and rose 16% when predicted to increase only 2% (2020).

Consensus S&P 500 Estimates vs. Actual Returns (2018 to 2024)

Data from 1/1/2018 to 11/30/2024. Sources: Emily McCormick, “What Wall Street Strategists Forecast for the S&P 500 in 2019,” Yahoo Finance, December 31, 2018; Jeff Sommer, “Clueless About 2020, Wall Street Forecasters Are at It Again for 2021,” New York Times, December 18, 2020; Jeff Sommer, “Forget Stock Predictions for Next Year. Focus on the Next Decade,” New York Times, December 16, 2022; Senad Karaahmetovic, “Top Wall Street Strategists Give Their S&P 500 Forecasts for 2023,” Investing.com, December 27, 2022; and Tom Aspray, “Should You Worry That Strategists Keep Raising Their S&P 500 Targets?” Forbes, October 20, 2024. Past performance is no guarantee of future results.

Blueprint Investment Partners has also shared numerous examples of utterly useless market predictions from the “experts” over the last several years.

Predictions AND Certainties are Worthless Without a Plan of Attack

Before I get too up in arms about the inaccuracy of predictions, we should take a step back and remind ourselves that even IF these predictions were accurate, it still wouldn’t guarantee success for a financial advisor or their clients.

For example, if one knows the market will be at a certain level at a certain point but doesn’t know the exact path to take to benefit from the foreknowledge, then where’s the value? This is even more problematic when a withdrawal needs to be taken before the known market endpoint.

Furthermore, we should not take for granted that investors will have the fortitude to sit through certain levels of volatility and drawdown even if they are confident in the ultimate destination. Look no further than reality to test for yourself whether that statement is true: The S&P 500 Index has averaged a strong return over many decades, and yet studies consistently show that investors underperform.

Predictions are More Dangerous than Guesses

What makes predictions dangerous, particularly reliance on them, is that it limits a financial advisor’s ability to take advantage of favorable market environments.

To illustrate, let’s assume an advisor believed 2024 would produce only modest returns and set their target at 4,800 for the S&P 500. Within the first quarter, the index exceeded 5,000. The advisor might have been tempted to take risk off the table. Perhaps they let it go as high as 5,500 before cutting risk. That would have left money on the table that could be crucial during down periods. It also would have left them out of position during the market’s continued march higher.

Sometimes what’s even more emotionally difficult than missing a rally is trying to figure out when to get back in.

At Blueprint Investment Partners, we talk about these challenges all the time. And until systematic trend following becomes mainstream, we will continue to do so.

The beauty of a systematic investing process is that it assumes nothing about markets and takes emotion completely out of the equation. A result is that we are rarely “out of position” with the markets. For example, we have repeatedly highlighted the absurd run by NVIDIA and how we have benefited accordingly.

7,400? 6,666? 6,600? 6,500?

Without any context, random numbers like those in the header above do not carry much meaning. In this case, that sequence of random, useless numbers captures some of the “expert” 2025 predictions for S&P 500 Index returns from the likes of JPMorgan Chase, Morgan Stanley, Goldman Sachs, Bank of America, and RBC. Almost comically, the average of those predictions isn’t too far off from the S&P 50’s average yearly return (thanks guys, very helpful).

While there are plenty of questionable traditions this time of year – like ugly sweaters, Christmas carols sung off-key, and market predictions – there are also some good ones, such as New Year’s resolutions. At Blueprint Investment Partners, our resolution is the same as always: We resolve to continue our disciplined executing of the trend-following systems that have allowed us to have…uh, if you’ll pardon me…peace on earth and goodwill between our partnering advisors in 2024.

We also resolve to continue exploring new ways to enhance the execution of our strategies and how we serve our valued clients. Our wish is that financial advisors will take some time in this new year to evaluate what matters most to them and seek us out to determine if we can help them get the most out of their practice in 2025 – whether that means growth, process improvement, or freeing up more time to spend with their family. We want nothing more than to help advisors succeed.

Sourcing for this post: Barchart.com, S&P 500 Index ($SPX), 1/31/2024; Avantis Investors, “Monthly ETF Field Guide,” November 2024; and Slickcharts.com, S&P 500 Total Returns, 1/1/1926 to 12/31/2024

Mike Carlone

Let's Talk

To discuss how we can help you get the most out of your practice in 2025