There’s No Wizard Behind the Curtain

Honestly, there’s not much of a curtain either.

Sparked by our recent whitepaper, The Elite Advisor Playbook, we’ve been having conversations with financial advisors about how to adapt to the new environment (and I don’t just mean the one created by the Coronavirus). These discussions usually lead to agreement that advisors struggle to modernize their practices.

However, two questions the Playbook does not answer are:

- Why is this framework an optimal picture of a financial advisor?

- How can it be implemented?

Today, we’re tackling the first.

In a separate post, we share resources that address the second.

When thinking about what eventually became The Elite Advisor Playbook, we started with our observations and looked for commonalities across our ecosystem with our clients and other firms before turning to the data. We realize there’s risk in relying on observations. For example, Daniel Kahneman is an author, psychologist, and economist who has written extensively about how our brains look for commonalities to explain a trend. Still, after 10 years of seeing what both success and mediocrity look like, we find one constant: a firm’s operational efficiencies portend its chances of being elite.

Therefore, to answer the aforementioned question – Why is this framework an optimal picture of a financial advisor? – we turn to an all too familiar source: the data. Here are some statistics and anecdotes that helped us develop our profile of an elite advisor.

Society’s On-Demand Expectations Extend to Financial Advisors

As a recent study by Vanguard found, “As much as 45% of the total value of an advisory relationship perceived by investors is derived from emotional elements, while the remaining 55% is derived from functional aspects of the relationship like portfolio management and financial planning.

Some may read this and conclude that the old way of doing things – a quarterly check-in or monthly phone call – checks this box. It doesn’t. Our society is on-demand and investors expect their financial advisors to provide emotional reassurance in contemporary ways, such as videos, blogs, and infographics.

This new reality necessitates a focus on client service above all else.

Efficiency Requires Scalability

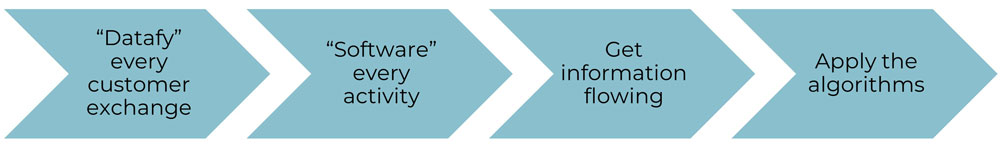

For the Playbook, we leveraged an article by Ming Zeng, Chief Strategy Officer of the Alibaba Group, about the characteristics of smart businesses. Our spin, of course, was its relevance to financial advisors:

Four Steps to Create a ‘Smart’ Advisory Practice

Well-intentioned financial advisors can quickly get over their skis if they don’t implement scalable practice management systems because all those, “It’ll only take a few minutes,” tasks pile up and distract from higher-impact activities. The need for a strategy around the development of a modern digital architecture is something our own firm relates to. We learned this lesson the hard way, and I wish we had read Ming’s article five years sooner!

A Jack of All Trades is a Master of None

According to a study published by Cerulli Associates, only 7% of financial advisory practices are suited to do their own research and portfolio management. Yet, 62% are in fact performing these functions on behalf of their clients.

Advisors have three options for spending their time – client service, business development, and investment management – and we think top financial advisors pick two. There simply isn’t enough time or resources to be effective at all three.

With that, client service is a no-brainer, leaving a choice between business development and investment management. The former cannot be outsourced effectively, but the latter sure can. Our first-hand experience as an outsourced asset manager has given us a front-row view of how outsourcing investment management can allow advisors to scale more rapidly.

The Power of Compounding Applies to Investments, Not Investors

The most common thread in all the research we have analyzed involving the distinctions that make an advisor elite is that they are great marketers and they understand what it takes to grow their businesses. But we also know this requires significant capacity on the part of most advisors today.

We see it time and time again, where a financial advisor gets too comfortable with what made them successful in the first place, fancying themself as a portfolio manager instead of a financial planner and relationship manager. In addition, the data is clear that consistently outperforming the market is statistically nearly impossible and compounded by the time allocation required to even pursue such an improbability.

As clients grow older, this leads to a slow bleed of assets.

Constant business development is how we think top financial advisors stay focused on the future health of their practices.

There’s No Wizard (But it Might Be Easier if There Was!)

We realize implementing the framework outlined in The Elite Advisor Playbook is ambitious; being best-in-class isn’t easy.

Behind the scenes, we’ve been working on some resources to help. Your success is our success.

Jon Robinson

Let's Talk

If you would like to discuss the Playbook or get some advice on implementing any of the Playbook’s suggestions