Communication At A Distance

First, I sincerely hope this note finds everyone safe and healthy in your world. We are grateful to be here to serve our clients and friends.

To paraphrase the line from the movie “Cool Hand Luke,” my Co-Founder Brandon Langley and I will not be accused of a “failure to communicate!” On the last trading day of every month, we rebalance our portfolios. At the same time, we send a note to our clients and partners to provide an update about what changes will be taking place in our strategies based on the status of the price trends we use in our systematic investing process.

This month, we want to share our note with our full audience because we believe it is insightful regarding the current environment.

To receive this note directly going forward, please subscribe here.

Asset Allocation Update

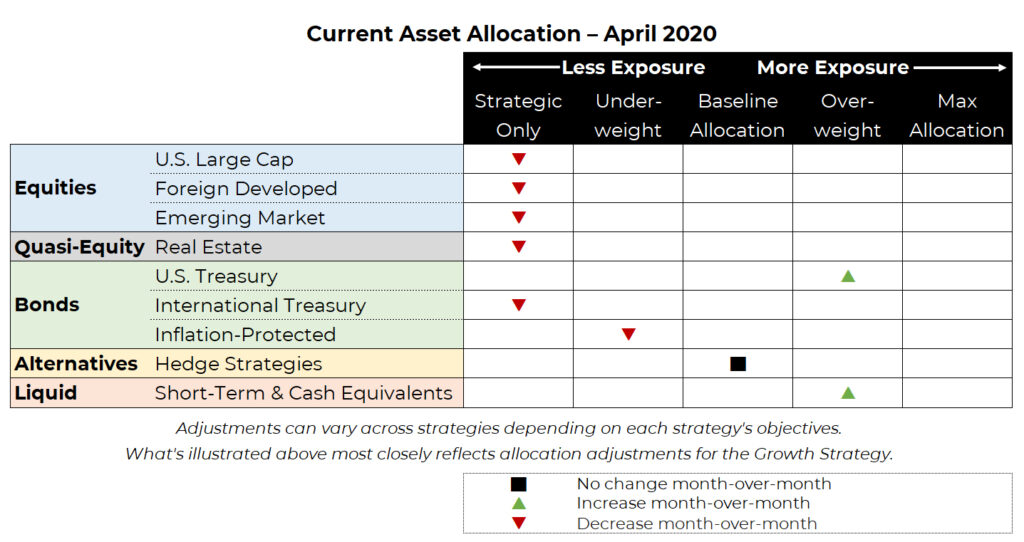

Below are the asset classes utilized in Blueprint Investment Partners portfolios, along with their model-driven exposures for April.

U.S. Equities: Decreased to the minimum allocation due to downtrends in all timeframes.

International Equities: Decreased to minimum allocations due to downtrends in all timeframes for both foreign developed and emerging markets.

Real Estate: Decreased to the minimum allocation due to downtrends in all timeframes.

Fixed Income: Uptrends remained across all timeframes for U.S. Treasuries, so exposure was increased. International Treasuries have experienced an intermediate-term downtrend, so its allocation was decreased accordingly. Overall, fixed income exposure of intermediate- and long-term duration is unchanged from last month.

Inflation-Protected Securities: Decreased due to an intermediate-term downtrend.

Short-Term & Cash Equivalents: Increased in all portfolios due to its strength in the yield curve, and due to taking on allocations from weaker equity and bond segments.

Asset Level Overview

Equities and Real Estate

In a word: historic.

Only the most notorious drops in the benchmark indexes provide historical comparisons for what has occurred in the financial markets since late February: the market crash of 1987, the Financial Crisis, the Great Depression. The Coronacrash of 2020 now joins this infamous list. And it has been by far the most rapid.

As is probably expected, Blueprint Investment Partners strategies are moving to minimum equity and real estate exposure across the board. After intermediate-term downtrends in late February reduced equity exposure across all our portfolios, a long-term downtrend have now occurred.

Fixed Income

Similarly historic has been the decline in yields among U.S. Treasuries, which resulted in a surge in bond prices through the first half of March. Valuations have since steadied but remain elevated across all segments of the yield curve.

Looking internationally, the massive impact of COVID-19 has actually weakened sovereign bond prices, leading to downtrends in those fixed income sectors. In Blueprint Investment Partners portfolios, this exposure will be re-allocated domestically.

With all Blueprint Investment Partners strategies reducing risk at a macro level, the overall fixed income allocation has increased for April. However, the increase in exposure will flow to U.S. short-duration bonds and cash equivalents, with average duration decreasing to three years from five years.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Coronavirus becomes a pandemic: U.S. equities fell to three-year lows as the coronavirus impacts all facets of everyday life in the U.S., Europe, and Asia. More than 200 countries or territories have reported cases. The COVID-19 outbreak is having a larger than anticipated ripple effect throughout the global economy, especially as more cases are diagnosed in the U.S.

Largest fiscal stimulus package in history: World War II cost the U.S. $4 trillion inflation-adjusted. It is difficult to fully calculate, but we are somewhere in the range of $5 trillion in total stimulus so far. This is a Main Street crisis, not a Wall Street crisis, so the effect of all the stimulus will not be known until after this is over. However, we know the stress on the financial system and the impact on GDP increases risk for investors overall.

Falling U.S. interest rates: Enhanced Fed stimulus drove the yield on U.S. 10-year Treasuries to all-time lows in March, and it is below 70 basis points as we write this note. The Fed announced it had no limit on its purchases of Treasuries and agency mortgage-backed securities, while also beginning to purchase investment-grade corporate bonds. In addition, the Fed revived the Term Asset-Backed Securities Loan Facility (TALF). A big unknown is the impact on the mortgage market, as distortions have caused significant challenges in pricing mortgages, which impacts the ability of borrowers to access credit.

Systematic Investing is Built For This

Schools and other organizations will periodically plan, prepare, and execute fire drills. Soldiers continually conduct training exercises to simulate real-life combat situations. Theater productions hold dress rehearsals. Why? The reason is to develop a mental imprint so that when real conditions are present – whether a fire, a battle, or opening night – individuals can lean on their training and execute their plan, rather than freeze in the intensity of the moment.

For asset managers like Blueprint Investment Partners, the Coronacrash represents a moment of truth. We consistently preach about the value of having a plan. This serves two purposes for asset management:

Having a plan optimizes for behavioral finance because it removes emotion and indecision when time is of the essence. In environments where uncertainty and fear are rampant, the value of flawless execution is paramount, with the benefits often remaining invisible until after the fact

It allows us to be completely focused on what matters most – our financial advisor clients and their investor clients. To us, being on the offensive in this environment looks like constant communication, transparency, and support.

This is exactly what Blueprint Investment Partners has been up to in March. After reducing exposure to equities at the end of February, just like we did prior to the sharp declines in December 2018, the Blueprint Investment Partners team spent the month producing new content pieces to convey our asset allocation decisions and provide context during these historic times. At the same time, we have been constantly meeting with our partners and their clients.

A couple recent content pieces you may want to refer to include:

While we have heard concern and anxiety among the folks we chat with, we have also experienced confidence and a sense of stability. Most investors have remained committed to the plans developed with their advisors.

Creating a measure of certainty, by having a pre-determined plan, can serve to calm nerves and keep clients focused on their long-term goals. It can be compared to a fire drill or evacuation plan: By visualizing negative outcomes and developing a series of response steps, financial advisors can project confidence and reduce fear. This, in short, is the power of partnering with Blueprint Investment Partners.

Looking Ahead

Much is being done to offset the economic damage done by the virus through unprecedented stimulus packages and central bank interventions, but tremendous uncertainty remains. Potentially historic unemployment and GDP contraction appear inevitable. As mentioned earlier, there are very few analogs with which we can compare, making it difficult to assign a range of possibilities, much less to identify a precise outcome. With circumstances like these, it is comforting to have a systematic investing process that allows us to bypass much of the chaos until a semblance of normalcy returns. If that happens sooner then expected, then we will be ready to capitalize.

Until then, our rules-based investing process will continue to guide our portfolios to lean into capital preservation.

Jon Robinson

Let's Talk

If you’d like more information about how your practice may benefit from using Blueprint strategies