Global Fund With Continuum-Based Approach to Risk Management

Whereas many asset managers take a binary approach to risk management – they’re risk-on, or they’re risk-off – Blueprint Adaptive Growth Allocation Fund (BLUIX) considers it on a continuum. BLUIX’s systematic investing process looks to reallocate to similar, stronger positions instead of heading to cash at the first sign of a downtrend.

An analogy is driving a car. When conditions are icy, you slow down to avoid a crash. But, it’d be foolish to keep driving at a crawl when the road thaws. Even a few snowflakes melting onto an otherwise clear road usually doesn’t warrant slamming on the brakes. With the proper mindset and equipment, you can adjust your speed to take advantage of smooth roads while managing for dangerous conditions.

A ‘Handoff’ Approach To Risk Management

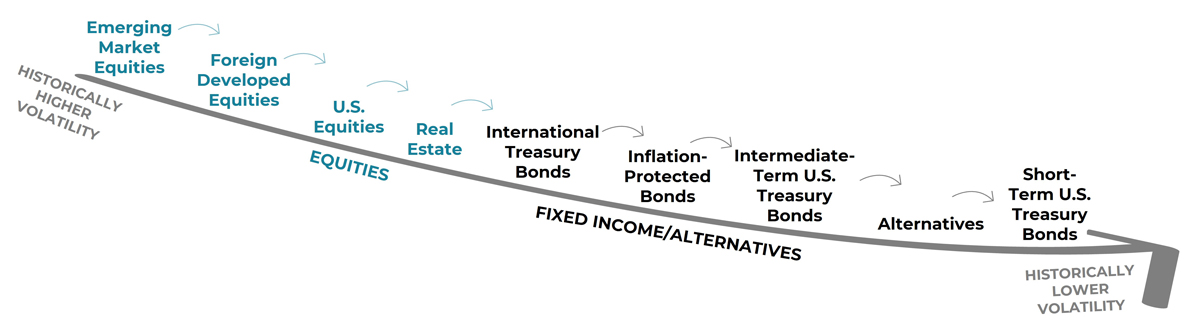

When a downtrend emerges in any given asset class

We “handoff” that exposure to the next asset class experiencing uptrends. This allows BLUIX to reduce risk without going completely “risk off.”

When an uptrend re-emerges

We “handup” exposure by taking from asset classes expiring downtrends or, if several are in uptrends, by shifting exposures for historically lower-volatility classes back to their baseline weightings.

5 Primary Attributes Blueprint Adaptive Growth Allocation Fund

Global Asset Allocation

Portfolio diversification across eight major global asset classes in a single investment vehicle

Rules-Based Process Optimized for Behavioral Finance

Systematic investing process answers questions about what, when, and how much to buy and sell – repeatable rules that maintain discipline during prolonged market volatility because we want to leave no room for emotional decision-making amidst euphoria or fear

Dynamic Adjustments in Response to Market Changes

Asset allocation naturally adapts to market conditions – portfolio can look quite different depending on the environment (e.g., when there are uptrends/downtrends in an asset class, interest rates change, volatility arises, or inflation/deflation occurs)

Focus on Managing Downside Risk

Constructed to manage risk during bear markets and severe drawdowns (like 2022 and the Coronacrash of March 2020), but doesn’t need to go completely “risk off” amidst less significant pullbacks (those that may affect only select asset classes, not the whole financial system)

Ongoing Tax-Loss Harvesting

Tax-friendly portfolio is possible by using a blend of timeframes – this time diversification allows losing positions to be sold quickly, but gains can be held as long as uptrends persist

Let's Talk

Please reach out if you’d like to learn more about BLUIX

Replicates Blueprint’s Flagship Separately Managed Account

BLUIX imitates the Blueprint Tactical Growth Strategy, the flagship SMA for Blueprint Investment Partners since January 2013.

Blueprint Investment Partners claims compliance with the Global Investment Performance Standards (GIPS®) and has been independently verified for the period of January 1, 2013, through December 31, 2021.

Let's Talk

If you’d like to learn more about BLUIX, a risk-managed, global asset allocation fund