The Outperformance Of U.S. vs. International

August 31, 2021

Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

—John Templeton

In our conversations with advisors recently, we consistently discuss helping clients stay tethered to their goals despite the staggering market heights and constant barrage of negative news. There is a memorable scene in “Alice in Wonderland” that sums up this conundrum nicely. Alice asks the Cheshire Cat, “Would you tell me, please, which way I ought to go from here?” The cat replies, “That depends a good deal on where you want to get to.”

It seems most investors acknowledge that consistently trying to time the market is a fool’s errand. For us at Blueprint Investment Partners, this is a primary reason why we’re data centric and market agnostic. Emotions can tear a hole in the most solid of plans. So, for us, there’s no need to question, “Where are we going?” especially within the confines of a goals-based process. Owing to the Templeton quote above, couldn’t you make the case that equity markets fall in all four camps — pessimism, skepticism, optimism, and euphoria — simultaneously?

In this Co-Founders’ Monthly Note we look at U.S. stocks in comparison to their international counterparts. The last decade has not been kind to international stocks on a relative basis. Is this an area of concern for investors going forward? We review the data and help shed light on that question.

But first, here’s a summary of our take on what transpired in the markets in August.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

As August draws to a close, the headline on equity market performance is similar to previous months: U.S. stocks, particularly large caps led the way, with almost every other segment struggling to keep up. Mid-cap stocks also had a strong month, but the picture is less rosy for small-caps companies or anything outside the U.S. Even real estate stocks, which have been the big winner so far in 2021, lagged in August.

Despite the vast differences in performance, there are no trend changes requiring us to alter allocations. U.S. equities and real estate remains entrenched in uptrends, along with foreign developed equities. Emerging markets exposure will remain constant heading into September, continuing in the intermediate downtrend that began in July, and the long-term trend remains positive for now.

Fixed Income & Alts

After sustaining a bounce back that caused uptrends, U.S. fixed income stalled in August. The nearer-term trends remain positive, with longer-term trends still negative. The August pause also applies for international and inflation-protected. Despite the stall in momentum from previous months, both of these fixed income segments continue to have uptrends across both timeframes.

Continuing the theme of lackluster performance for everything besides U.S. stocks, gold experienced another decline in August. The result is continued downtrends across both time frames we monitor. Thus, our allocation to gold will continue to be at its minimum.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Taper Talk: Fed Chair Jerome Powell reiterated the central bank’s intention to begin tapering later this year if the economy performs as expected. However, he decoupled asset purchases from rate hikes. The timing and pace of the coming reduction in asset purchases are not intended to be a direct signal regarding the timing of interest rate liftoff, for which the Fed has articulated a different and substantially more stringent test.

Maximum Employment: Federal Reserve officials are talking more about how to define a fuzzy concept, maximum employment, which is often described as the unemployment rate consistent with stable inflation. Max employment appears to have rebounded and will heavily influence the Fed’s thinking around how much longer to keep interest rates near zero. Workforce participation, a measure of the share of 25- to 54-year-olds who are working or seeking jobs, has also rebounded from its COVID lows but remains well off the 2019 highs, which had just managed to recover from the 2008 recession. The current levels are akin to the 2017/2018 levels.

Supply Chain Challenges: The Delta variant outbreaks add to a long list of challenges — including delays at ports, freight-container shortages, and rising raw-material prices — that companies face in delivering goods at low cost and on time ahead of the holiday season. Supply chain experts say the added costs from lockdowns in Vietnam and other Asian countries will further increase the sales price of consumer goods. Additionally, Taiwan Semiconductor, the world’s largest contract chipmaker is raising prices by as much as 20%, according to The Wall Street Journal, a move that could result in consumers paying more for electronics. Taiwan Semiconductor Manufacturing plans to increase the prices of its most advanced chips by roughly 10%, while less advanced chips used by customers like automakers will cost about 20% more, these people said. The price increases come in the wake of a global semiconductor shortage.

The First Rule Of Fishing

The first rule of fishing is fish where the fish are.

—Charlie Munger

We often use this section of the Co-Founders’ Monthly Note to highlight an interesting aspect of the markets or our strategies. This month, we have the opportunity to accomplish both. As we highlighted above and have written previously, the performance divergence between U.S. stocks and the rest of the world is staggering in its longevity and consistency.

Take almost any rolling time period over the past 10 years and you will find that U.S. equities, on the whole, outperform international equities. While the historical correlation between these asset classes is high, the daily accumulation of small differences in performance leads to a large divergence when measured over a meaningful amount of time.

There are many examples from recent history, but August provides yet another compelling example of the difference (as of August 30):

- U.S. stocks: near 3% for the month

- Foreign developed equities: up approximately 1%

- Emerging markets: flat to up slightly

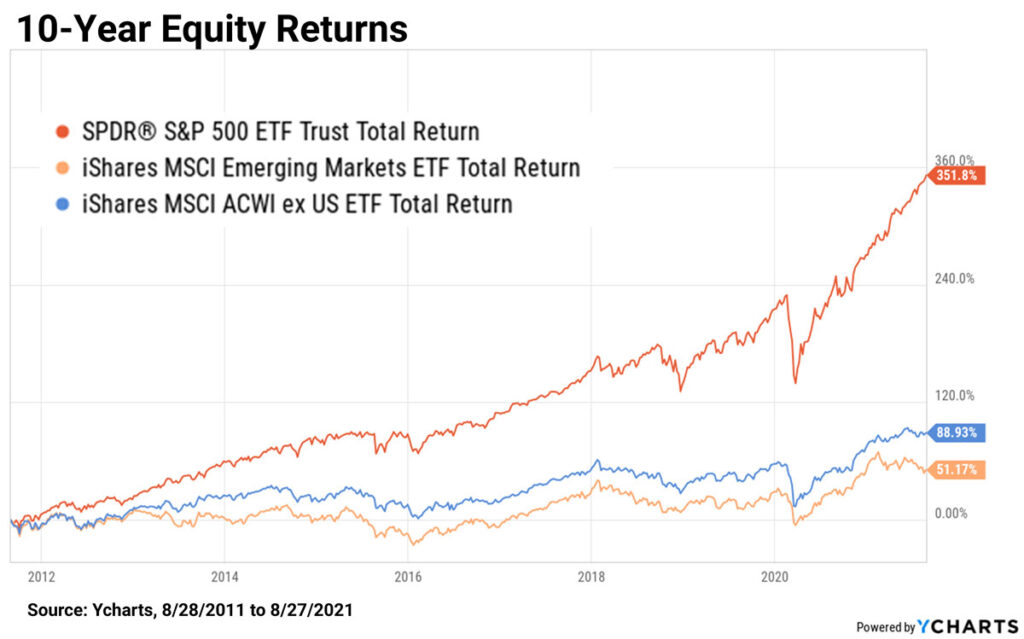

Taking a step back from one month to a larger sample of 10 years, the magnitude becomes clear:

- U.S. stocks: almost 360%

- Foreign developed equities: returned a little under 90%

- Emerging markets: just over 50%

These differences feel almost like different classes of assets altogether.

Does this mean diversification should be cast aside? Not quite. Most professionals agree diversification is a good thing, but that doesn’t mean it comes with no cost. As with most things in life, there is an optimal balance to be achieved. If diversification is good, then precise diversification is better.

In our view, this highlights once again the importance of importance of being adaptive by using an objective, systematic process. While startling, these vast performance differences represent a tremendous opportunity to outperform the competition and provide superior returns.

For us at Blueprint Investment Partners, applying Munger’s principle means first having a process for monitoring and using many asset classes, including international equities, but secondly having rules that govern how much exposure is actually budgeted. Like now, there have been other significant stretches over the last decade when our equity exposure was more concentrated toward the U.S. Static portfolios containing meaningful allocations to foreign and emerging indices would not have fared nearly as well.

Like all trends, the outperformance of U.S. versus international is unpredictable and can persist for a long time, creating an edge for us to exploit. Our trend following processes give us an objective lens by which to view the world and take advantage of these opportunities when they arise.

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process