Is Everyone A Market Timer?

June 30, 2022

Everyone times the market. Some people buy when they have money, and sell when they need money, while others use methods that are more sophisticated.

—Marian McClellan

It’s an interesting question: Is everyone a market timer? OK, probably not everyone. But in some ways, the decline experienced in U.S. stocks this year highlights the difficulty that many market participants – and dare I say some financial advisors – have in remaining patient as they go on a bottom-fishing expedition.

The objective of such actions is clear: Advisors are attempting to improve their average price by buying when stocks are repriced lower. But we believe the CATALYST for these actions is a form of recency bias driven by the Fed’s introduction of nearly unlimited capital into the system every time even a minor drawdown in stocks has occurred since the Financial Crisis.

If you assume this time is no different, why not buy?

That’s a big assumption. And it gives outsized weight to the experience of the last 12-years without considering the experience of the decades upon decades before that. When you consider a larger sample size, the data yields very different outcomes and actions.

The point is that indiscriminate buying based on falling stock prices is not a plan. Timing the market is not a plan. Often both of these disregard the fact that you might be wrong. In this month’s Co-Founders’ Note, we discuss how perceived opportunities can turn into traps without the proper plan to tell you when you’re wrong. It is an old adage to which we subscribe: “Stay humble or the market will do it for you.”

But first, here’s a summary of our take on what transpired in the markets in June.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

In June, the S&P 500 officially reached the dreaded bear market designation, by exceeding a 20% decline from its previous peak. Mid- and small-cap equities fared even worse, both declining more than 25% from their 1-year high. Even value and high-dividend stocks, holding up much better than their cap-weighted counterparts YTD, succumbed to renewed selling pressure. The result is that no segment of U.S. stocks has been able to maintain an uptrend. Hence, Blueprint Investment Partners portfolios will continue to be underweight U.S. equities as we enter July.

As U.S. equities were hitting their lows for the months, international equities were holding up a bit better, but still incurred losses and remain in downtrends. After lackluster performance in 2021 compared to U.S. equities, the longer-term performance of this segment continues to be dismal. In fact, since January 2021, foreign developed and emerging market equities have produced a cumulative loss of 13% and 15% respectively. As has been the case for much of this time, all Blueprint Investment Partners portfolios continue to have minimum exposures to international equities.

Repeating the same themes of domestic and international equities, real estate securities also produced losses in June. Rising interest rates have finally dented demand, causing downtrends to remain entrenched. After reducing exposures heading into June, all Blueprint Investment Partners portfolios will remain underweight to this asset class in July.

Fixed Income & Alts

After showing the smallest of signs of a bottom for the first time since late February, fixed income assets renewed their declines in June, making new lows by mid-month. All Blueprint Investment Partners portfolios continue to be underweight fixed income instruments of any meaningful duration, as they have since the third quarter of 2021.

Despite seemingly having so many factors that would support a gold rally – from inflation to war – this asset class continues to underwhelm. As June closes, exposure in Blueprint Investment Partners portfolios will decrease, as a long-term downtrend has developed in addition to the already established intermediate-term downtrend. With the Fed intent of quashing inflation, it would seem the opportunity has been missed for gold. On the other hand, just as things seemed so lined up for a rally that didn’t happen, perhaps another counterintuitive move is in store that will finally produce a strong return.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Past: The final revision to the Q1’22 gross domestic product report came out, and it shows that real GDP (inflation-adjusted) was -1.6% annualized. While the revision was small from the previous report, the composition changes were disappointing. Consumer spending on both goods and services were revised down significantly and was offset by inventory accumulation, which is less than ideal. Building inventories for businesses in an environment with slowing spending is unhelpful for longer-term growth if those businesses must sell at discounted prices in a few months.

Present: Consumers’ short-term outlook for the U.S. economy dropped to its lowest point in nearly a decade on concerns about inflation. The Conference Board’s consumer-confidence index, which hints at American attitudes toward jobs and the economy, dropped to 98.7 in June from 103.2 in May. The board’s expectations index, which measures consumers’ short-term outlook about the labor market, business, and income, tumbled to 66.4, its lowest reading since March 2013. The University of Michigan’s closely followed survey of consumer sentiment, which polls consumer attitudes on personal finance, dropped to its lowest point on record.

Future: Yields on U.S. Treasuries are rising abruptly as the Federal Reserve lifts interest rates to try to cool inflation. This could increase the federal government’s borrowing costs over time to levels higher than currently projected. Government spending on net interest costs in the fiscal year that began last October totaled about $311 billion through May, a nearly 30% increase from the same period a year earlier. Some budget analysts say an increase in the federal government’s borrowing costs could crowd out spending for other priorities and add to the overall U.S. debt held by the public. Some analysts suggest that, when the Federal Reserve cuts rates in the future, it should all balance out. However, this leaves out the possibility that inflation could be persistently higher, leading to persistently higher rates.

Seeing Opportunity: Buying Products vs. Buying Strategies

A perceived opportunity can turn into a trap without the proper plan to tell you when you’re wrong.

—Jon Robinson & Brandon Langley

Did we just quote ourselves? Yes.

Yes, we did.

I believe the kids call this “cringey.”

Please forgive us, but it is our custom to incorporate an impactful quote as a springboard for our commentary. After failing to find something adequate this month, we thought, why not create our own?

Getting to the point, we have been struck by the number of advisors who identify the current decline in equities as a clear buying opportunity. As our regular readers might expect, we have no strong opinion either way on what the future holds. All we know (and care about) is that trends are down, so we are positioned accordingly (which has done just fine so far), and we will be until things change.

What is alarming about the level of conviction (and subsequent knife-catching, err…buying) is not that it exists, but rather that it rarely coincides with a definitive plan for what to do next. XYZ fund or stock is bought with the idea that it’s now a bargain. WHEN (not if) it goes up, it will be held until…?

What happens if it goes back down?

If the market rallies from here, that’s fantastic in our opinion. Like everyone else, we will position portfolios accordingly to seek to benefit. We are very unlikely to catch the exact bottom, and we’ll only know the eventual lows in hindsight.

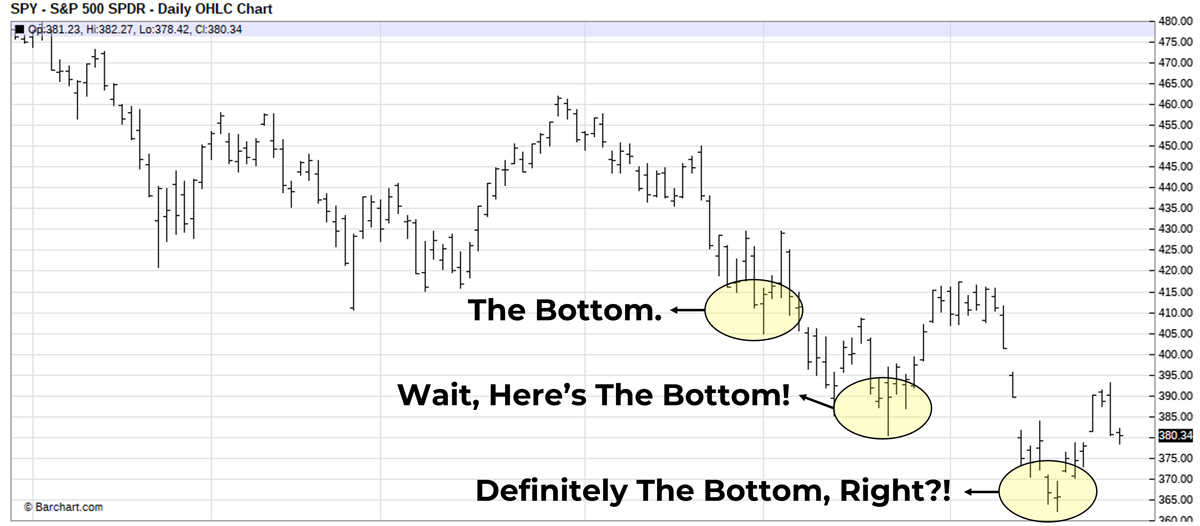

The Problem with Trying to Catch the Bottom

Source: Barchart, 7/1/2021 to 6/29/2022

After all, the average equity market drawdown for a recessionary period in the U.S. is -37%. Thus, if one believes a recession is imminent, or at least highly likely, then it is equally likely that we have further to fall in equities. The beauty of having a plan is you don’t have to catch the bottom (or even care about it).

Rather than try to guess when a bottom has formed, why not let the market tell you when it is ready? A good example of this is in Chinese equities. After making numerous new lows and eventually falling around 50% from its all-time high in February 2021, they have now created their first intermediate-term uptrend in over a year.

While we have heard several advisors tell us that the U.S. is an opportunity right now, no one has said this of China. We would consider China a better opportunity, not because we believe advisors are any worse at prediction than we are, but because the data points in that direction, at least for Chinese large caps.

Trend Change in China

Source: Barchart, 7/1/2021 to 6/29/2022

There is a difference between buying a PRODUCT (which typically lack in a plan for how to address all the contingencies of the market) and buying a STRATEGY, such as one based on systematic investing principles. In our view, now is potentially a risky time to buy products, but a good time to invest in strategies like trend following, which can adapt to whatever happens next.

Attentive readers of our Co-Founders’ Note likely understood from last month’s edition that we were preparing everyone for the prospect of our defensive posture being met a fierce rally in equities. Fortunately for us, that turned out to be unnecessary, as new lows in June simply showed yet again the value of a systematic process.

As we enter July, we want to yet again prepare our readers. There’s a reason for the phrase “bear market rally.” It is common for a market to reach a point of reduced selling pressure, when all that’s temporarily left are buyers. This can lead to a brief rally before selling pressure resumes, leading to another round of new lows.

We are unphased by bear market rallies because they typically result only in indexes closing our outperformance gap. If at the end of July we sit in the same place as the benchmarks, have less risk, and offer superior cumulative performance due to previous outperformance, then have we really lost anything? No. In fact, we will have continued to provide enhanced risk-adjusted returns.

On the other hand, if equities (and fixed income) fall further in July, then it would widen the gap between our risk-managed performance via systematic trend following and many other indexes. Under these conditions, advisors who choose to “buy the dip” could face more pressure from clients, who may be tempted to change their timeframe for reviewing performance from annually to daily to hourly. In our experience, when this happens, it’s not long until the client’s flight response appears.

It is scary to make changes to client portfolios during times like this. We get it. In times like this, we think it’s helpful to reminding oneself of that saying about how it’s never the wrong time to do the right thing.

For those already partnering with us, we hope the benefits are encouraging to you and your clients. For those still on the fence, we look forward to serving you soon.

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process