Is 2022 Mirroring 2008?

September 30, 2022

Our patience will achieve more than our force.

—Edmund Burke

In recent conversations with family members who know we are in the investment world but don’t fully understand what it is that we do, we have received condolences. “Man, I bet this has been a hard year, huh?” is the common comment. How to answer? Given that we have been and remain defensive against further equity declines, it is both an easy and difficult response.

If the conversation continues, the question around missing the “inevitable” rally usually comes up. It’s difficult, in most environments, to explain how avoiding large losses can benefit long-term compounding – but it is especially hard while standing with the adults at a kid’s birthday party. I usually simply shorten the story to: bear market rallies are common, and patience pays off.

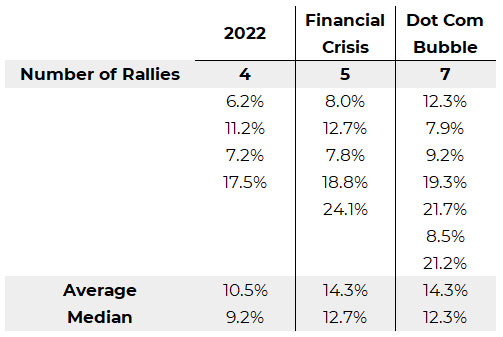

How common are these rallies? Below is a table outlining the S&P 500 Index’s bear market rallies during the Dot Com Bubble, Financial Crisis, and 2022.

Bear Market Rallies

Source: Stockcharts.com and Blueprint Investment Partners

In short, bear market or countertrend rallies are common, and when they happen, they can be considerable in magnitude, particularly as the bear market persists. As a systematic investing asset manager, to us, this data is both anecdotal and medicinal. We are happy to sit out these rallies until a rising trend forms, especially if it means having protecting capital when the rally ends and new lows occur.

In this month’s Co-Founders’ Note we continue this discussion and lay out the benefits and perils of comparing 2022 to past bear markets, notably 2008. Regardless of the similarities, investors must keep their egos in check to remain objective and stick to their processes. At Blueprint Investment Partners, this is in line with one of our core values: Win Together. The question we ask is: Would you rather LOOK SMART or WIN?

But first, here’s a summary of our take on what transpired in the markets in September.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

U.S. equities are ending the month like they began: poorly. Even in negative months, there is usually a bright spot in one segment or sector. But, a stroll through month-to-date performance results for the various S&P sectors shows that there was no place to hide.

This may not come as a surprise for those of us who recall that September has historically been, at least in modern stock market history, the worst performing month of the year. While some of the worst months in memory have happened in October, its predecessor is actually the one that is worse on average. And if ever a poor-performing month was going to live up to its reputation, it seems appropriate that it happen in 2022, with equity markets in downtrends. Blueprint Investment Partners portfolios have now spent the majority of 2022 underweight U.S. equities, and they will continue as such in October.

While U.S. indexes narrowly surpassed their June lows, international stocks blew through them decisively. Both developed and emerging markets accelerated past their prior year-to-date lows, setting the stage for continued downtrends. Fortunately, Blueprint Investment Partners portfolios have been at their minimum allocations to international equities for much of 2022 and will continue that way as we enter Q4.

As is to be expected when equities are falling and interest rates are climbing, times are not good for real estate securities. After being a top performer in 2021, real estate is now challenging growth and tech as the worst-performing U.S. equity sector for 2022. Accordingly, all Blueprint Investment Partners portfolios remain at their minimum allocation.

Fixed Income & Alts

Another month, another new low for fixed income. After a reprieve in July from 2022’s decline, bonds resumed their slide in August and have followed by breaking the June low this month. There’s no sugar-coating it: things are looking ugly for all segments in fixed income, from U.S. Treasuries to corporates, municipals, inflation-protected, and international. Other than the lowest of durations, there is simply nowhere to hide.

Gold followed equities and fixed income in making new lows in September. Exposure will remain at its minimum in our portfolios, as downtrends remain in place. With only one quarter left, time is running out for gold to take advantage of what on the surface appeared like an ideal set of circumstances due to inflation, instability, and war in Europe.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

It’s Been a Long While: Japan intervened in the foreign-exchange market for the first time in 24 years when it bought yen this month. The rare move is an example of global concern resulting from a strong U.S. dollar, which is tied to the Fed increasing interest rates. “The core cause of the dollar’s strength, particularly against the yen, is the interest-rate differential between the U.S. and Japan,” reported The Wall Street Journal.

It’s Never Been Before: The U.K.’s pound hit its lowest-ever level against the U.S. dollar earlier this week. Investors are worried about the government’s plans to cut taxes, and the Bank of England has signaled an interest rate increase is coming. The Wall Street Journal noted that Kallum Pickering, a Senior Economist at Berenberg bank, expressed: “Much of the investor concern isn’t necessarily about whether the U.K. government will honor its debts, but rather a view that the tax cuts will spur higher interest rates down the road and thus check much of the economic growth that the new government hopes to achieve.”

And Also, It’s Lower for Lumber: Lumber prices have fallen to their lowest level in more than two years. Pricing for two-by-fours is now in line with the pre-pandemic cost. The news signals an abrupt slowdown in construction, and new permits for residential construction has been declining since March. The National Association of Home Builders reports that builder confidence declined in September for the ninth straight month. It’s pessimism not registered since the pandemic lockdowns of the 2020s and 2008 housing crash.

Bear Market History Lessons

History doesn’t repeat itself, but it often rhymes.

—Mark Twain

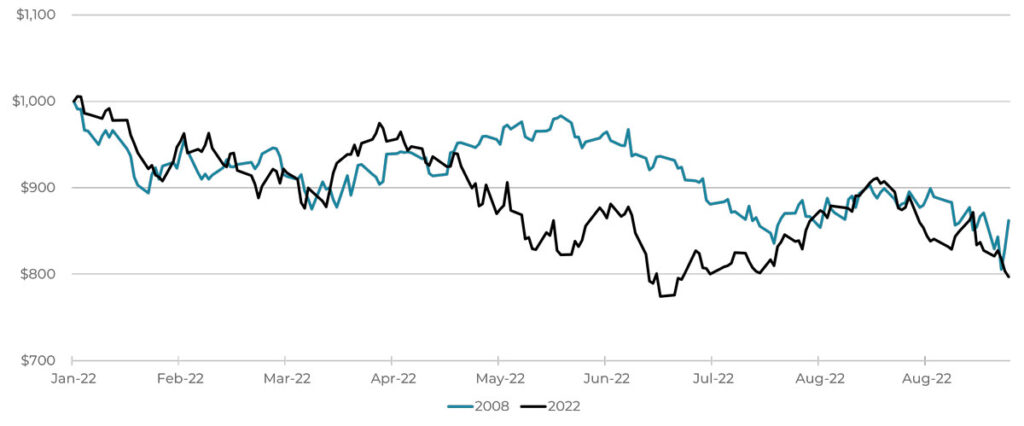

The graph below shows the decline of $1,000 invested in the S&P 500 SPDR ETF (SPY) at the beginning of a calendar year through nearly the end of September (9/23). One line is 2022. The other is 2008. There’s a part of us that wants to keep it a mystery and let readers discover which is which for themselves. However, to stay on your good side (and to keep our friends in compliance happy), we’ll reveal that the teal line is 2008 and the black is 2022.

Decline of a Hypothetical $1,000 Investment in SPY 1/1/2008 vs. 1/12020

Source: ICE, 1/1/2008 to 9/23/2008 and 1/1/2022 to 9/23/2022

After studying an enormous array of market price data and monitoring it daily for the better part of two decades, it’s second nature for us to see similarities between time periods. “That reminds me of…” is a common phrase at Blueprint Investment Partners. What is striking about 2022 is how it has, in many ways, mirrored 2008.

The shared characteristics begin at, well, the beginning. Both 2007 and 2021 showed very few fundamental signs of what was ahead. Sure, in hindsight you hear all the stories about warning signs and how we should have known better. However, the reality is that there are always signs that can be misinterpreted as negative for future returns. On the flip side, there are plenty of data points to support a rally.

This highlights two important points: investing is hard, and scenarios like today are why we choose to be systematic trend followers.

If you are the world’s greatest predictor of markets but get it wrong badly just once, the downside can be catastrophic. On the other hand, if you can consistently put yourself in the best position to succeed, then it becomes difficult (not impossible, mind you) to get it wrong in a lasting way. This ability to survive is often underestimated but, in our view, is critical to long-term investing success.

Once you get your head wrapped around that philosophy, then it’s just a matter of ego. Would you rather look smart or win? At Blueprint Investment Partners, our core values are:

- Take Ownership

- Win Together

- Think Systematically

- Be Adaptable

- Champion Transparency

The essential ingredient in Winning Together is keeping your ego in check. While completing projects, or even making routine decisions, there are opportunities to do what is right OR what makes you look good. Winning Together means always doing what is right, which sometimes means humbling yourself and submitting to someone else’s view.

Which brings us back to 2008 versus 2022. Following systematic investing rules in a disciplined way has allowed us to sidestep a portion of 2022’s declines thus far. This goes for both stocks AND bonds. Moreover, with our strategies positioned very defensively heading into Q4, it leaves us much less exposed if we experience another leg down in either or both asset classes. (Read our “Anatomy of a Bear Market” blog for more on this.)

But guess what? 2022 is not 2008, and no one knows for sure what happens next. Just as following our rules allowed us to decisively get and remain defensive, following our rules will also get us aggressive when and if prices dictate that.

Winning Together at Blueprint Investment Partners means the obvious things, like completing projects and seeking compelling risk-adjusted returns. But it also means creating an environment where the real heroes of our story – our partnering financial advisors – can help their clients remain on track to meet their goals, whether 2022 is a repeat of 2008 or not. For us, this is where purpose and process meet.

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process