Circumventing The Wall of Worry

August 31, 2023

What we hope ever to do with ease, we must first learn to do with diligence.

—Samuel Johnson

There’s an oft-spoken cliché about how markets climb a “wall of worry.” Whether influenced by global upheavals, monetary policy, or evolving market dynamics, uncertainties are inherently part of investing.

Hoping for the conditions to look different is easy to do but unlikely to change reality. What we can learn to do with diligence is circumvent our own biases. At Blueprint Investment Partners, we seek to accomplish this with disciplined execution of our repeatable investing rules. Having a precise and robust process keeps us from being derailed when we encounter the “wall of worry.” We walk around the wall versus trying to scale it.

In this Co-Founders’ Monthly Note, we discuss what we believe is an important ingredient for outperformance in the context of how our systematic investing process approaches managing risk. In sharing our risk handoff strategy, we describe how we ease away from weakening asset classes without going completely “risk off.”

But first, here’s a summary of our take on what transpired in the markets in August.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

September is historically a seasonally weak period for stocks. Right on cue, equities suffered a broad sell-off in August. While fairly uniform in the decline, growth and tech stocks suffered more than their value and dividend-oriented counterparts. Despite the retracement, trends remain firmly positive in the U.S.

While uptrends persist domestically, it’s not so internationally. Both foreign developed equities, which have enjoyed mostly uptrends in 2023, and emerging markets moved into intermediate-term downtrends. This weakening will result in exposure being shifted to stronger U.S. equities due to our risk handoff strategy, which is discussed in more detail below. For now, the long-term trend continues to be positive internationally, but that status could change during September, particularly for emerging markets.

Real estate saw an end to its short-lived uptrend over the intermediate term. Both timeframes are now in negative territory, resulting in reduced exposure back to minimum allocation, where the asset class has spent most of 2022 and 2023. Like international stocks, this exposure will be passed along to U.S. equities for now.

Fixed Income & Alts

Fixed income returns in August were, in a word: bad. The temporary uptrend in international fixed income died a quick death, pushing our allocation back to its minimum alongside all other fixed income segments of any meaningful duration. The beneficiary from an exposure perspective continues to be ultra-short-term fixed income instruments.

Gold also saw a trend reversal. The intermediate-term trend returned to negative territory, meaning exposure will decrease. The long-term trend remains positive.

Sourcing for this section: Barchart.com, Growth ETF Vanguard (VUG), 8/1/2023 to 8/28/2023; Barchart.com, Nasdaq Composite ($NASX), 8/1/2023 to 8/28/2023; Barchart.com, Value ETF Vanguard (VTV), 8/1/2023 to 8/28/2023; and Barchart.com, High Dividend Yield Vanguard ETF (VYM), 8/1/2023 to 8/28/2023

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Gasoline Woes: Gasoline prices recently reached their highest levels so far this year, with the national average for a gallon of regular at about $3.82 at the start of this week. That is about 60 cents higher than at the start of the year. The climb in oil prices could complicate the Federal Reserve’s effort to lower inflation to 2% and is already weighing on small-business owners, with companies delaying upgrades, losing workers who do not want to pay more to commute, and charging customers higher prices.

Loan Woes: Restarting a $1.6 trillion federal student loan program is creating confusion. Pandemic relief is ending, and borrowers will start owing interest as of September 1, with the first bills due as soon as October 1. Several issues are complicating the process, including the fact that about four of every 10 borrowers have loans that were transferred to a new servicer, as well as how millions of former students graduated or otherwise left school during the pause and have never been required to make a payment – until now.

No Used Homes: The Commerce Department reported 714,00 new homes were sold in July, at an annual rate, up from totals in June and July last year. Additionally, the National Association of Realtors reported that just 980,000 existing single-family homes were for sale in July, which is the fewest in the month of July dating back to 1982. The low supply means elevated prices for existing homes and increased demand for new homes.

Sourcing for this section: The Wall Street Journal, “Rising Gasoline Prices Hit Inflation-Weary Americans,” 8/28/2023; The Wall Street Journal, “Student Loans Are Emerging From Deep Freeze, and Borrowers are Confused,” 8/28/2023; and The Wall Street Journal, “How High a Rate Can Housing Take?” 8/23/2023

An Ingredient For Outperformance

In preparing for battle I have always found that plans are useless, but planning is indispensable.

—Dwight D. Eisenhower

Financial advisors often tell us that a unique feature of our tactical investment strategies is the process by which we “handoff” exposure among asset classes, from weaker to stronger.

Let’s use emerging markets as an example to illustrate our approach. Within our diversified portfolios, our systematic investing rules dictate when to increase and decrease this exposure based on trends within the asset class. If a downtrend forms, exposure is reduced. That begs the question of where the exposure is sent. Many tactical managers will send it to cash or a lower volatility asset, such as fixed income. This is also something we will do if certain conditions are met, but we don’t think it should be the first or only option.

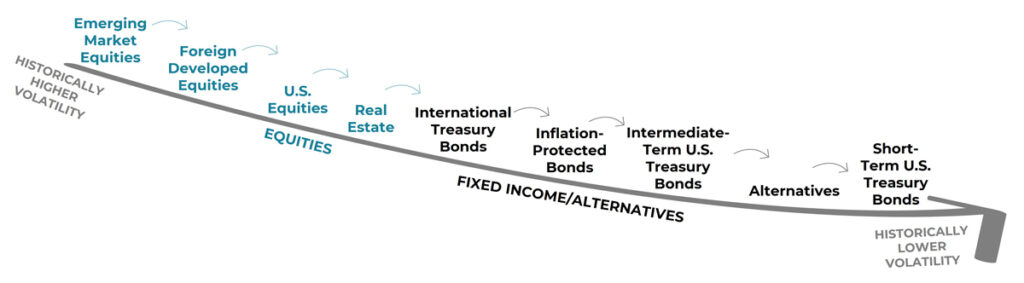

Instead, we have created a process for systematically moving along a chain of similar assets in search of stronger, positively-trending markets that may offer greater return potential than fixed income or cash. We call this our risk handoff strategy.

Risk Handoff Strategy

Still using the emerging markets example, instead of moving directly to cash, we will first look at the next closest comparable asset class. Within our portfolio construct, based on volatility and correlation, the next asset is foreign developed equities. If foreign developed equities are in an uptrend, we will move the vacated emerging market exposure there. If not, we will look at the next closest (U.S. equities) and so on. After all other equity-like options are exhausted, we end up with fixed income or cash equivalents.

You may be asking why we bother with the additional steps. After all, this process is not without some potential cost in the form of more trades, possibly resulting in short-term capital gains.

Well, our entire systematic investing process is rooted in a large amount of time and research that backs our conviction. The risk handoff strategy is no different. We believe a significant opportunity for outperformance exists versus a passive benchmark – and other tactical strategies – when we utilize a simple yet sophisticated series of steps to ease away from weaker assets. This is not a predictive process but one that leans heavily on the idea that trends are more likely to persist than end.

Here & Now: Our Handoff to U.S. Equities

This month’s set of allocation changes offers a great example of what we described above. Both foreign developed and emerging market equities are experiencing downtrends, resulting in us shifting some of this exposure to the U.S.

During the last decade, there have been long stretches where U.S. equities have vastly outperformed their international peers:

- U.S. – almost 200% return (Total Stock Market ETF Vanguard, VTI)

- Foreign developed – 53% return (FTSE Developed Markets Vanguard, VEA)

- Emerging markets – 32% return (FTSE EM ETF Vanguard, VWO)

Compare those returns to the US Aggregate Bond Ishares Core ETF (AGG), which returned only 12%, and you see the potential value in being able to systematically shift exposure over time to stronger asset classes rather than immediately move to fixed income. We believe this is a key component in maximizing compounding, as well as an area where trend following shines.

In addition to this long-term perspective about the relative strength of U.S. equities, let’s consider some shorter-term context.

In last month’s Note we highlighted how 2023 was the third-best start for the S&P 500 in 30 years of history. In years that started strong, the average return for the remainder of the year was approximately 9.4%, as highlighted by the graphic from last month:

Best Starts to the Year for the S&P 500

Source: GFD, SPDR S&P 500 ETF Trust (SPY), 2/1/1993 to 7/26/2023

Given the recent tendency of U.S. equities to outperform other asset classes over both short- and long-term timeframes, we have high conviction in this being a good place to handoff international equity exposure in times like now, when emerging markets and foreign developed are in downtrends. Of course, this doesn’t guarantee anything in terms of outcome, but as a firm favoring methodical processes over unpredictable outcomes, we have confidence in the current positioning.

We are fond of saying that to be different in terms of results you must be willing to be different in terms of process. We think our risk handoff strategy is a great example of this. Being different can be scary, but the reward comes from seeing how our approach performs over the long term and supports financial advisors in helping clients stay on course to reach their goals.

Sourcing for this section: Barchart.com, Total Stock Market ETF Vanguard (VTI), 9/1/2014 to 8/28/2023; Barchart.com, FTSE Developed Markets Vanguard (VEA), 9/1/2014 to 8/28/2023; Barchart.com, FTSE EM ETF Vanguard (VWO), 9/1/2014 to 8/28/2023; and Barchart.com, US Aggregate Bond Ishares Core ETF (AGG), 9/1/2014 to 8/28/2023

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process