Predicting The Future

When something happens that has never happened before, do we assert it was unpredictable?

Monday the front month contract for WTI crude oil went negative in price and traded there, as holders attempted to get rid of the obligation to take delivery. How much can I pay you to take my oil? Amazing.

Times like this challenge everything we think we know about the financial world. It also begs the question, “Can anyone really predict the future value of any asset?”

At Blueprint Investment Partners, we believe that no one really can.

‘But It’s Never Happened Before!’

The refrain about it never happening before is in the same genre as, “This time is different,” and, “History repeats itself.”

The reality is: The market does not care that something has never happened before.

Neither do we. And we therefore believe the only information of clear value in making asset allocation decisions is the price of an asset as determined daily by each respective market. That’s the foundation for our systematic investing process.

History Does Have A Story To Tell

As has been said many times before, a picture says a trillion words (the modern version anyway).

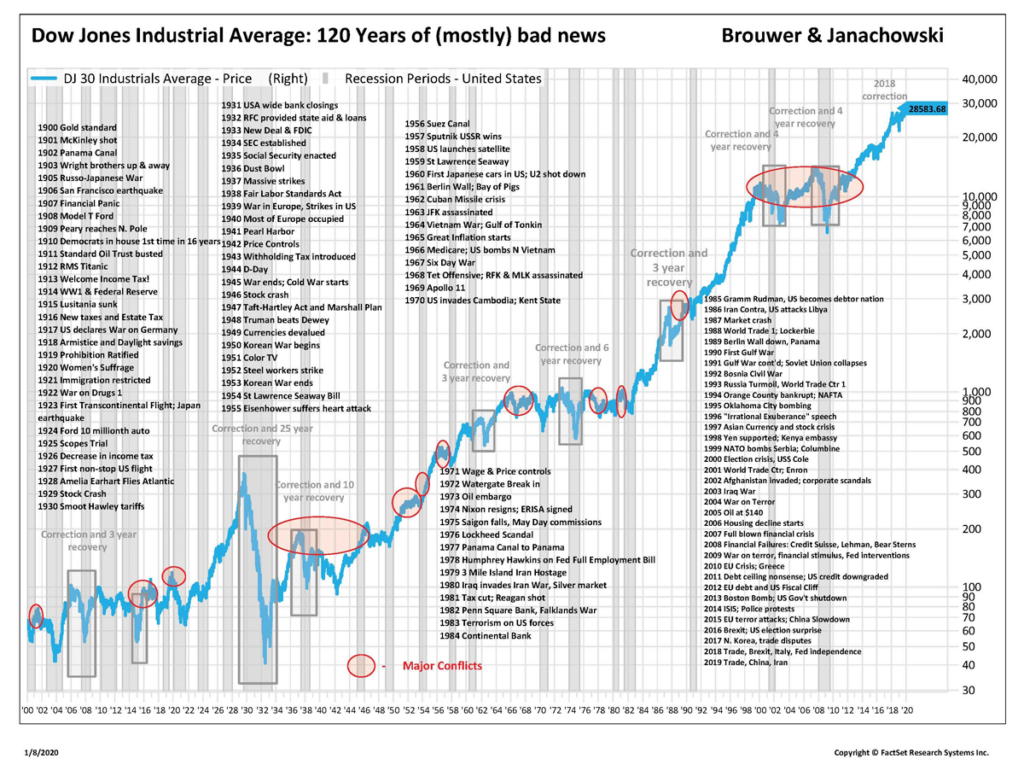

The 120 years of Dow history picture below presents a story that, during many periods of challenging financial conditions, the value of the market has not only recovered but moved on to higher prices. This history also reveals a picture a of entrepreneurship, productivity, and ingenuity. But it does not predict the future!

In fact, consider what this chart tracks: not earnings, interest rates, or cash flows. It’s literally one of the simplest data point you can find: PRICE. It’s the closing price of the Dow during the last 120 years.

Why Price Matters

As Blueprint CEO and Co-Founder Jon Robinson often says, “The price of an asset at the close of a day turns what was into what is.” And the trend of the price of any asset gives us clues about the direction in which it’s headed so we can apply our systematic investing process.

Note that I did not say price predicts direction, but it offers clues.

So back to what has never happened. It has now happened. Oil has cratered. What do we know?

We know that tracking the price trend over any number of time frames would have suggested a downtrend early in February, indicating an investor might want to sell or short the commodity.

Simply tracking price would have allowed a glimpse into the future, not in the future direction of prices, but in your reaction to them at various levels.

Predicting vs. Systematic Investing

Hindsight is 20/20, and in this case the trend could have easily reversed itself. But the fact is no one knows the future, and a catastrophic loss requires an asymmetric result to regain the prior value. Using a systematic investing process to step aside based on the price trend allows investors at least the opportunity to maintain buying power and increase the potential for future compounding.

Attempting to predict the future is just short of a fool’s errand, in my view. I say that with great respect to all the brilliant people who attempt to predict market outcomes. But after 30+ years in this business, I am convinced now more than ever that only occasionally can a market prognosticator get it exactly right.

Tracking an asset’s price will not get it exactly right either, but it should consistently tell you the truth.

Tommy Mayes

Let's Talk

If you’d like to learn more about Blueprint’s systematic investing process