The Line Between Chasing Winners And Catching a Falling Knife

A few weeks ago, my family spent a week at the beach. There’s this arcade on the boardwalk. I’m sure you know the kind: Drop a $20 in the change machine, hope your 8-year-old can keep the Skee-Ball in her own lane, and then trade your tickets for some plastic toy that inevitably will provoke several sibling squabbles until it snaps in half a few days later.

Good ol’ American family fun!

As we dropped quarters in the machines, I noticed something interesting about my daughter’s approach to choosing which game to play that I thought had parallels to investing. She raced from game to game, chasing the ones she thought would give her the most tickets per play. When we made it to the prize counter, surprisingly, she ended with fewer total tickets than my son, who mainly just knocked over clowns with an air gun.

In the investing world, I think too many investors took a similar chase-the-return approach during 2020 and even now in 2021.

Those who hunted for returns in a haphazard way likely vastly underperformed, just like my daughter when she literally ran from game to game hoping to strike ticket gold.

It would have been a serious challenge for the average investor (or advisor) to keep up with the swinging pendulum of 2020 and 2021. Here are just a few examples:

2020

Growth and tech stocks dominated U.S. equities

U.S. government bonds performed well

Value and dividend stocks suffered significant drawdowns and dramatically underperformed their growth counterparts

2021

Growth and tech stocks are now near the bottom, with some indexes negative for the year

U.S. government bonds are in a bear market

Value and dividend stocks have become leaders and produced strong returns

Systematic Investing Makes Tomorrow’s Decisions Today

Please don’t misunderstand me; it’s not that I think pursuing return is bad. After all, isn’t that the whole point of investing?!

Where I think the “bad thing” comes in is when investors chase returns without a concrete plan.

The team at Blueprint Investment Partners think there’s tremendous value in having a plan for all types of environments, regardless of the current state of the market. Pre-determining how you will react to a future event not only removes biases from impacting your decision-making ability, but also gives you the freedom to enjoy conditions in the present.

At Blueprint Investment Partners, our systematic investing plan is concrete, adaptable, and transparent. We invest in each major global asset class, and we make allocation adjustments based on the intermediate- and long-term trends taking place in each class.

We think the argument for taking this systematic, yet asset-class-agnostic approach was strengthened by the market disparities between 2020 and 2021. In 2020, you may have received an overall portfolio return below the long-term average unless you were disproportionately invested in very specific sectors or factors; in 2021, this is again true, but with an almost completely opposite set of holdings; and in both years you likely had a “smoother ride” if you used a systematic investing process to drive allocation decisions.

Equity-Like Return, Bond-Like Risk/Volatility

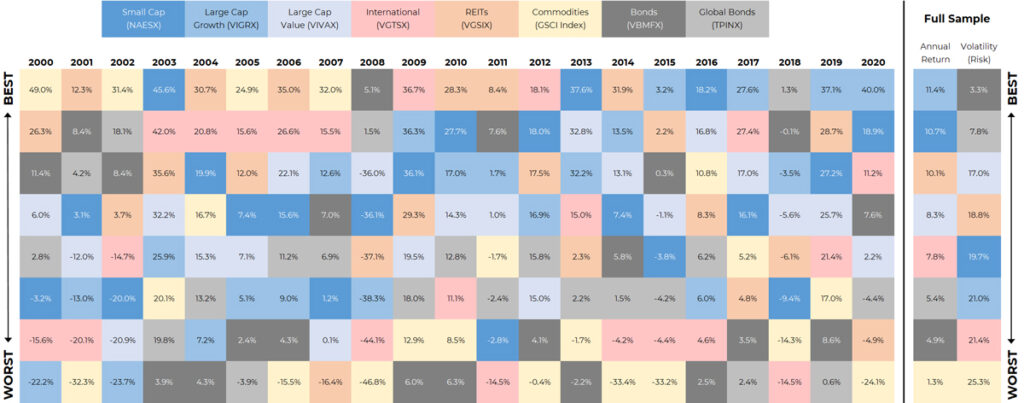

Many financial advisors are familiar with the “periodic table” of asset class performance like the image below, which is a popular tool for illustrating the importance of diversification to clients. Borrowing from chemistry, it shows calendar years from left to right, with individual asset classes lined up under each year in descending order of their performance. The main point is to show that any asset class can vary widely from one year to the next, going from a top performer to one of the worst. Thus, it is best to diversify.

Global Asset Class Annual Returns (2000-2020)

To help financial advisors visualize the impact of asset class diversification and time diversification, Blueprint Investment Partners has taken the “periodic table” concept a step further by adding:

- A buy-and-hold diversified portfolio to show the impact of asset class diversification

- A trend-followed diversified portfolio to illustrate the effect of asset class diversification and time diversification

Financial advisors can review the Blueprint Investment Partners periodic table.

What jumps out to me when I look at the Blueprint Investment Partners periodic table is how using the trend-following approach provided a more stable progression through the table. Returns were only occasionally near the top, but also (and perhaps more importantly) they were rarely near the bottom (a testament to the ability of systematic investing to account for downside protection, in my view). We believe the final result over the full sample is a more equity-like return profile, but more bond-like risk/volatility behavior.

We think 2020 and so far in 2021 present near-perfect examples of why this is important. If you chased returns, or tried to catch the falling knife in fixed income, when you went to redeem your tickets at the arcade prize counter, you may only have received a Chinese finger trap. The alternative is an approach that may more consistently rewards players with three parachute men and a couple pieces of candy. It isn’t married to any one asset class or factor, but it is unwaveringly rooted in a philosophy of being systematic as a means of adapting to whatever sets of facts dominate the market.

Jon Robinson

Let's Talk

If this is a topic you’d like to discuss further