Did Your Retirement Bucket Spring a Leak in 2022?

Not 2008, not the early 1980s, but 2022 was the worst year for bonds on record, according to an analysis by investment historian Edward McQuarrie.

That’s more than a headline for financial advisors who have relied on fixed income as the less-volatile portion of their 70/30 or 60/40 portfolios – especially for their retirement-age clients. It’s a breakdown that can have lasting effects on those who can afford it the least, unless the advisor has a strategy for mitigating the risk of those impacts.

Napoleon’s Bond Portfolio Would Have Done Better Than The Ones of 2022

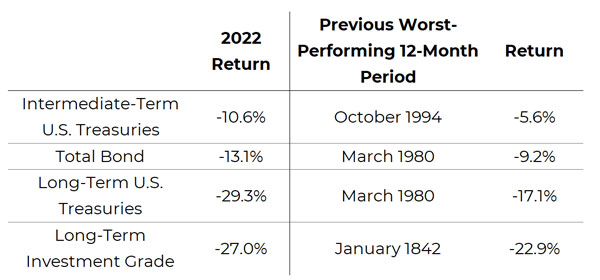

Here are a few of the highlights – er, lowlights – from 2022:

The Total Bond Index surpassed its previous worst 12-month return set in March of 1980 by almost 4%, dropping more than 13% versus the prior record of 9.2%. It was the worst year for intermediate-term Treasuries since at least 1926. Additionally, 30-year Treasury bonds lost almost 40%.

To put the 30-year Treasury decline into perspective, the maximum drawdown of the S&P 500 Index during the Financial Crisis and tech bubble burst was approximately 50%. Edward McQuarrie’s analysis even finds that the last time global bond markets were this bad, Napoleon was in power!

Problems With The 60/40 Portfolio

At Blueprint Investment Partners, we’ve been sounding the alarm about pain on the horizon for financial advisors who rely too heavily on the traditional 60/40 approach for years. We first published our “The 60/40 Problem” white paper in 2018. Then, in 2022, we pulled on the same thread but in the context of protecting retirement income.

“An Advisor’s Guide to Protecting Retirement Income” analyzes different approaches to sustaining clients throughout retirement. I think a shortcoming of most of the tools reviewed in the paper is that they don’t emphasize management of the portfolio itself as a means of enhancing retirement income, which can make them highly subject to the whims of the market in years like 2022.

An alternative is to use a form of systematic investing, which creates a dynamic glidepath that is adaptive. With this approach, portfolio adjustments are driven by what’s happening in the market at any particular time, irrespective of the investor’s age or retirement year.

Systematic Investing in 2022

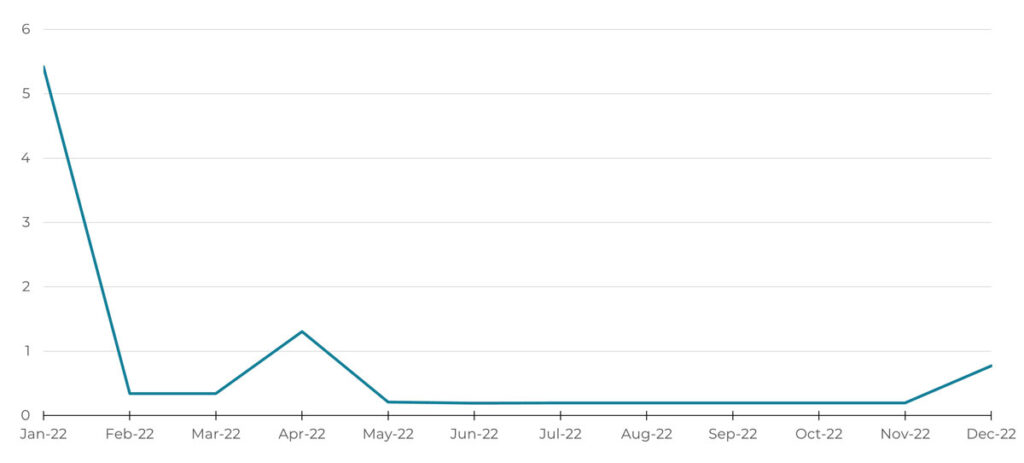

The systematic investing portfolios offered by Blueprint Investment Partners spent the year underweight their baseline allocations for bonds of all classifications and durations. In fact, our portfolios were generally at or near their minimum allocation.

When there was no other place to allocate due to equities, real estate securities, gold, and bonds all showing downtrends, our portfolios were overweight only one thing: ultra-short-term bonds and cash equivalents. These performed relatively well, boosted by inflation and an inverted yield curve.

Blueprint Tactical Growth Strategy: Weighted Bond Duration (Years)

In my view, the important part of this story is not simply WHAT we did, but HOW we did it.

We applied our systematic investing rules to bond prices, just like we do for any other asset. These rules measured the price trends in bonds and generated signals for us to reduce exposure where we could and reduce duration when we could not escape having some exposure.

The HOW distinction is important because it should give financial advisors confidence that we are disciplined about following these rules regardless of the asset class, the market environment, or the trend direction (down, in this example, but also up when things eventually recover).

This distinction leads to another important message: Advisors shouldn’t use Blueprint Investment Partners strategies because you believe we are about to have a great year in 2023. Advisors should use our strategies because you believe our process and discipline will well-position your portfolios to meet your clients’ investment goals.

Do Your Portfolios Have a Contingency Plan?

Some commentators use the 2022 decline to argue that now is a great time to buy bonds.

They might be right.

But, in my view, the key question for financial advisors is: What if those commentators are wrong? In our view, portfolios should be allocated based on a process that has a plan for either outcome. Ours do.

Jon Robinson

Let's Talk

If you’d like to discuss our systematic investing process