Bubbles: Are We In One and Does It Even Matter?

Perhaps the most striking characteristic of economic bubbles – which is also what fuels their very existence – is our blindness to them.

Historically, few have correctly called a bubble in advance. And yet, in modern times, people have been asking if we’re in the bubble since 2010. What gives?

An Implausible Gap Between Price & Value

One definition of an asset bubble is a situation where an asset’s price rapidly grows to the point of being disconnected from its inherent value. This typically occurs when something outside of hard data, such as emotions, drives exceedingly higher expectations and results in implausible gap between price and value.

The two most recent examples of asset bubbles are the Dot Com Bubble of the late 1990s to early 2000s and the Housing Bubble that culminated with the Financial Crisis of 2007 to 2009. In both cases, a near consensus for a “new normal” caused the disconnect between price and intrinsic value. Bubble calls were rare and generally rejected due to a “lack of understanding,” which is part of the reason why the number of people who profited from the eventual bursting were relatively few in number (but their profits were great in magnitude).

Why Goals-Based Financial Advisors Should Care

Before we attempt to learn from these examples to identify whether our current situation constitutes a bubble, let’s first ask if bubbles matter.

From an investment perspective, we at Blueprint Investment Partners believe the reason bubbles matter to advisors is because of their ability to distract your clients by taking them off track from the plan you establish with them.

This happens because bubbles play on our insecurities.

Here’s an example: One of the curiosities of managing money is how some people love to tell us about their success stories. “Hey, I bought Ford at $5 and now it’s at $10 per share!” You get the idea. Of course, they never mention the time they moved their entire 401(k) into their company’s stock right before it went bankrupt…details, schmetails.

The point is that insecurities cause investors to chase returns and make suboptimal decisions (FOMO, anyone?). Said another way, these choices rarely fit into a well-thought-out financial plan.

Over the long term, the average investor tends to underperform indexes, and the role insecurities play in taking them off-course is perhaps the chief example of why.

Can It Be a Bubble If Your Eyes Are Wide Open?

So, what lessons can we take from the Dot Com and Housing Bubbles, as we try to determine if we are currently witnessing another one?

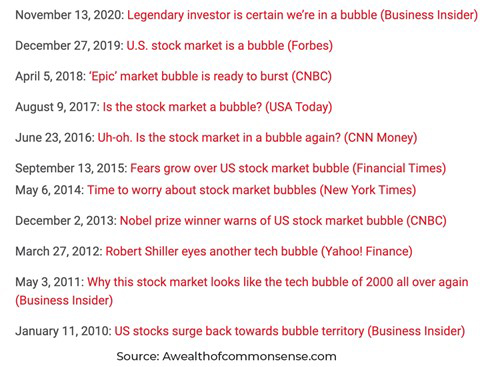

The irony is that bubbles can’t be recognized by the masses, yet since 2010 there have been numerous stories claiming we’re in one:

To take it a step further, a recent E-Trade survey revealed that two-thirds of investors believe we are in a bubble, with another 25% agreeing we are near one. That means more than nine of 10 respondents think we are in or near one.

If one of the defining characteristics of a bubble is the denial of its forming, then doesn’t most investors believing we are in one preclude its current existence?

And now for my disappointing response – I do not think so…but I do not know.

(Waiting for you to stop reading and X out the browser.)

(Still waiting.)

Why Rules-Based Investors Might Be Yawning

Oh, you’re still there? Great, because despite my inability to definitively rule out the existence of a broad economic or asset bubble in financial markets, I can offer something even more important for financial advisors.

Here it is: Bubbles don’t have to negatively impact your practice or your clients. In fact, with the proper processes a bubble simply represents another opportunity to squeeze in above-average returns in a short amount of time, offsetting inevitable periods of low relative return.

A proper process can take on many forms, but it must account for both bubbles and crashes. Doing so places all the emotion and excitement toward the building of the strategy, not its execution. We sometimes refer to this as “panicking in advance.” In other words, design a process that allows you to answer the question, “Can I handle X or Y if my system does A or B?” If yes, proceed. If no, then a change to the process is probably needed before implementation.

At Blueprint Investment Partners, we use simple, yet elegant systematic investing rules and focus on the price of the asset to determine when to be overweight, underweight, or out of an asset altogether. This allows us to keep calm and stay focused on what really matters for advisors and their clients: hitting the long-term financial goal.

In short: Our process was built for uncertainty, euphoria, fear, volatility, and calm waters. Whatever the market throws our way, our process is already prepared to roll with the changing tides.

‘When I See A Bubble Forming, I Rush to Buy, Adding Fuel to the Fire.’

The above quote comes from George Soros who, regardless of what you think of his political motives, is one of history’s best investors.

When commenting on bubbles, he has made several interesting points. We are particularly drawn to the reasons he offers for why he is unafraid of bubbles and in fact welcomes them: It’s the existence of a defined process. If one knows how to manage portfolio risk (or can partner with someone who does), then a bubble is just another set of market data.

So, how do advisors set about managing risk in a bubble or any emotionally charged market environment? According to Soros, it’s not in becoming paralyzed by the prospect of being wrong, only in failing to confront and address our worst tendencies.

In our opinion, step one to avoiding the paralysis is establishing a defined, adaptive investment allocation process or partnering with someone who has one.

At Blueprint, we define success as deciding on goals, sticking to them, and building a team that can help you achieve them. We continue to believe our process and strategies are tailor-made for advisors who are focused on their clients’ long-term goals, want to help investors stick with them, and need a partner who can achieve them – both within and outside of a bubble.

Brandon Langley

Let's Talk

If you’d like to discuss our systematic investing process and strategies that are tailor-made for financial advisors who are focused on their clients’ long-term goals