80%+ of Beneficiaries Want to Fire You. Here’s How to Prevent It.

You’re probably familiar with the American TV game show “Family Feud,” where families compete against each other to guess the most popular answers to random survey questions. There are many clips on YouTube that highlight guesses that are hilarious, dumb, and unexpectedly correct.

While the show is generally lighthearted, if the following question were put to the contestants, we suspect most financial advisors would find the answer jarring:

Name something next-generation high-net-worth clients do within two years of their inheritance:

Top answer: Switch financial advisors (81) —World Wealth Report 2025 from Capgemini

While this may seem like an industry crisis, it also presents an opportunity for forward-thinking advisory practices, individual financial advisors who are eager to try a new model, and financial services partners capable of providing scalable practice management solutions.

Responding to the Next Generation’s Priorities

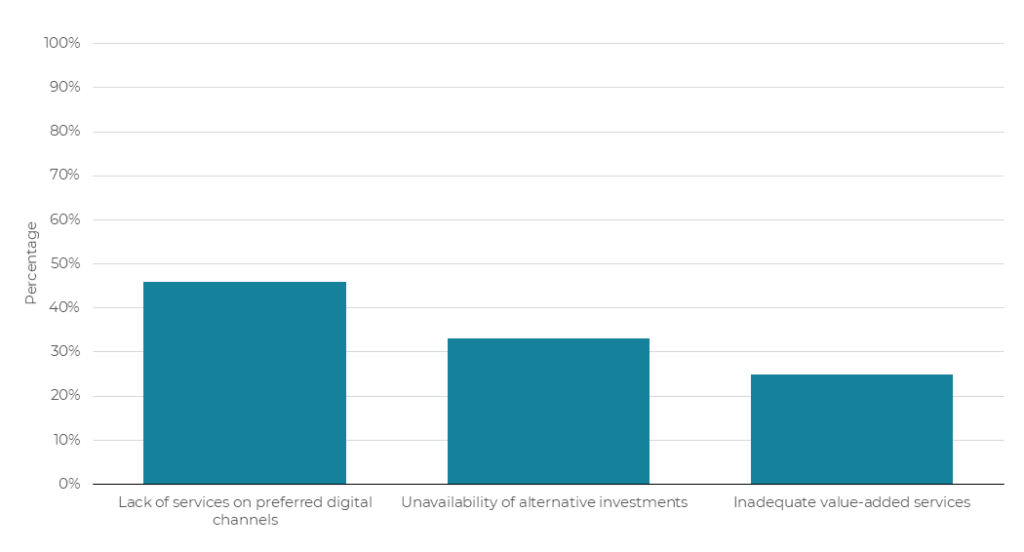

The Capgemini survey respondents cited several reasons for ending relationships with their parents’ wealth managers:

Reasons Cited for Leaving a Parent’s Wealth Management Firm

Retaining these clients will require new approaches:

- Modern and niche product offerings, such as private equity, cryptocurrency, and offshore investments

- Customizable auxiliary offering, such as estate planning, philanthropic advising, concierge services, lifestyle management, and legal consultation

- Seamless digital capabilities that provide real-time access to financial information, opportunities to connect with an advisor quickly – including by video, and secure digital transactions

Oof. For some financials advisors, that is a daunting list, which is completely understandable. Whether professionally or personally, we all fall into habits and routines that are comfortable for us. It’s difficult to step outside of our box. As a casual example: For 40 years I’ve used a fork in my right hand to shovel food into my mouth at the dinner table; if suddenly I had to switch to chopsticks in my left hand, I would struggle!

For most financial advisors, making progress on the list above will require:

- Partnership with other advisors, professionals from new disciplines, and solution-focused service providers

- Leveraging technology that can unlock productivity in order to create capacity to focus on strategic projects and the human-touch side of financial advising

Succession Planning Has a Role to Play

A separate but related issue facing the industry is a looming shortage of financial advisors. Recent and upcoming advisor retirements are driving this problem, and it’s happening at the very moment demand for personal financial guidance is reaching new heights.

Thoughtful succession planning can make a dent in the advisor shortage problem AND help address the next-generation’s desire for a new model of financial advising.

We all understand that wealth management is built on relationships. Advisors guide clients through life’s financial complexities, earning trust over decades of steady service. But as many of these veteran financial advisors prepare to retire, a noticeable gap is emerging. Without a clear succession plan, firms lose both advisors and the client relationships that define their businesses.

It’s a significant financial risk for many firms. Yet, many advisory practices are stuck in a reactive mode, scrambling when key advisors leave rather than proactively training new talent before transitions occur.

The solution? Treat succession planning as an ongoing, strategic priority. Firms that identify and mentor successors early on will be better equipped to:

- Keep their client base intact

- Attract top-tier talent who are eager for a clear path to leadership

- Serve the priorities and preferences of multiple generations concurrently

In short, thoughtful succession planning programs – ones that include multi-year transition plans, early introductions between clients and younger advisors, and mentorship – can create a competitive advantage.

For young financial advisors, this shift presents a rare career opportunity. As seasoned advisors transition out, there’s an unprecedented window for new talent to step up, take on responsibilities, and build long-term client relationships. The firms that win in the next decade will be the ones that invest in rising advisors now, ensuring a seamless transition when veteran professionals retire.

‘The Great Wealth Transfer’ Coincides With ‘The Great Opportunity’

Exactly how much wealth will change hands in the years to come is up for debate, but most experts agree it’s at least tens of trillions. Capgemini’s report put it at $84 trillion in 23 years.

The landslide gaining momentum doesn’t have to be a crisis for you; it can be a call to action.

Ultimately, the future of wealth management belongs to those who don’t just react to change — but actively shape it. The opportunity is here. The only question is: Who – and what – is ready to take it?

At Blueprint Investment Partners, we are committed to helping financial advisors thrive in this changing landscape. By providing the tools, support, and efficiencies that help advisors run their firms more effectively, we enable them to focus on what truly matters: growing their practices, delivering exceptional client service, and fortifying their businesses for the future.

Mike Carlone

Let's Talk

To discuss if the tools, support, and efficiencies Blueprint Investment Partners offers to financial advisors can help you turn the advisor shortage into an opportunity