You Know Who’s Terrible in a Crisis? A Robot.

Call me a luddite if you like, but few things annoy me as much as when I navigate to a new webpage and that, “How can I help you?” box pops up on the lower right. That chatbot entering uninvited always sends me on a frantic search for how to make it disappear as quickly as possible.

Those bots have fully infiltrated the online world: banks, municipal governments, dental offices, nonprofits. Even a robot for my neighborhood grocery store recently wanted to talk to me when I simply needed to verify the hours!

I think about this scenario as it relates to investors. With so much money moved into robo-advisors, what is the experience going to look like when REAL people have REAL questions? “How did the S&P close yesterday?” is easy for a robot. But what answer is going to pop up when the question is, “The market is collapsing! What should I do?” or, “How do I reduce risk in the midst of this volatility?”

More to the point of this blog: How different would the answer be if it were coming from a trusted financial advisor?

Faced with those questions from an investor, an advisor can spend an hour on a video call with their client. The advisor can go over the client’s financial plan, show how risk management is built into the portfolio, and provide reassurance that the investor remains on track to meet their long-term goal despite whatever turbulence is happening in the market. I imagine that is going to go a heck of a lot further in squashing anxiety for an investor than a popup window with the words, “I’m sorry. I’m not able to understand your question. Please call us during normal business hours.”

First Comes Disdain, Then Comes Marriage

Please don’t mistake my dislike for chatbots as a hatred for tech broadly, or even a questioning of its value within financial services.

Unlike many advisors and asset managers, whose fight-or-flight instinct kicked in with the emergence of robos, Blueprint Investment Partners has always seen them as an opportunity for partnership. If you know our firm, that shouldn’t shock you, given our attraction to systems, processes, and anything that can help remove human bias from investing.

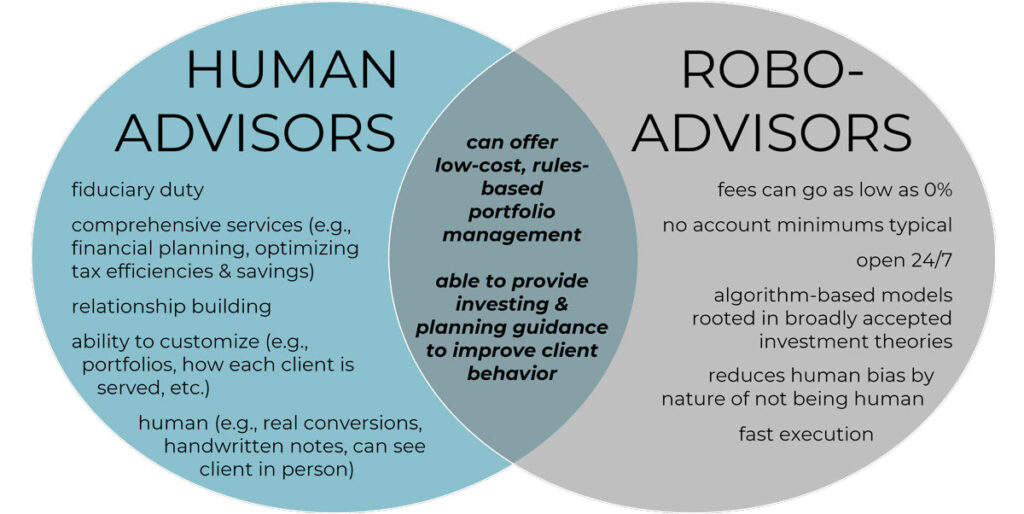

Robo-advisors have unique attributes. Period. So do their human counterparts. Also period. It’s not an either-or proposition in my mind or, so it seems, in the minds of the “powers that be” at UBS, which is acquiring robo-advisor Wealthfront for $1.4 billion.

When robos emerged and the exclusivity of portfolio management faded, that kicked off something I think was healthy for the industry. It began a slow purging of financial advisors who weren’t willing or able to provide additional value to clients. A catalyst for market equilibrium.

Top financial advisors, the ones who thrive in the new environment, adapted to offer robust, personalized services. Plus, they started leveraging technology to optimize their practices. Outsourcing portfolio management – whether to a robo or professional asset manager – has freed up capacity so they can focus on offerings that only human advisors can provide.

A Rude Awakening on the Horizon

Even as many advisors’ views of robos have evolved, too many investors still view the matter as an either-or that pits humans against robos.

I’m nervous about blowback.

Investors don’t think to contact their advisor (robo or human) to say, “You’re doing a great job. These returns are amazing!” But, when their statement shows -20%, I’m betting they’re going to want to talk. And not to a machine.

This reality is a product of our prolonged bull market. The market has given investors too many reasons to devalue the role of real people advisors and human interaction. I think the pendulum will swing back. (I’d be tempted to predict it might already be starting to swing if I didn’t think a few perceptive readers would rightfully call me out for contradicting our firm’s stance that predictions are trash.)

Preaching to the Choir

When I find myself getting worked up about this or one of my other “hot button” topics, I try to remind myself of the following from author Roy T. Bennett: “Instead of worrying about what you cannot control, shift your energy to what you can create.”

The reality is that we – the team at Blueprint Investment Partners and you, our reader – don’t have the ability to control investors’ decision-making, especially for individuals with whom we don’t have an open line of communication. We are the choir who’s being preached to, not the minds in need of an awakening about the RISK of a robo-focused approach to investing. (Pun intended, because RISK management is one of the areas where I think the value of human advisors versus robo-advisors shows up in a big way.)

Since so much of it is out of our control, how can we shift our energy? What can we create? At Blueprint Investment Partners, we focus on being an uncommonly great partner to the financial advisors with whom we interact. We see the advisors we work with doing the same thing in their practices. They’re being uncommonly great partners to the investors they serve by taking a surprise-and-delight approach to client service, developing a regular communication cadence, making themselves available via whatever platform the client prefers (such as phone, video, or email), and being proactive with their outreach when the market gets choppy (you won’t find them hiding under their desks).

Focusing on what we can create doesn’t alleviate my worrying over things I cannot control every single time. But, knowing we’re doing the best we can to serve our partners certainly has a reassuring effect that I hope you also feel.

Jon Robinson

Let's Talk

If any of this resonates with you