March 2022 ESG Summary For Risk-Managed ESG Strategy

Source: Blueprint Investment Partners

For illustrative purposes only. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

This Month: Asset Allocation

49% equities, which will be down significantly from February and spread across 43 stocks, with 51% allocated to fixed income and cash equivalents

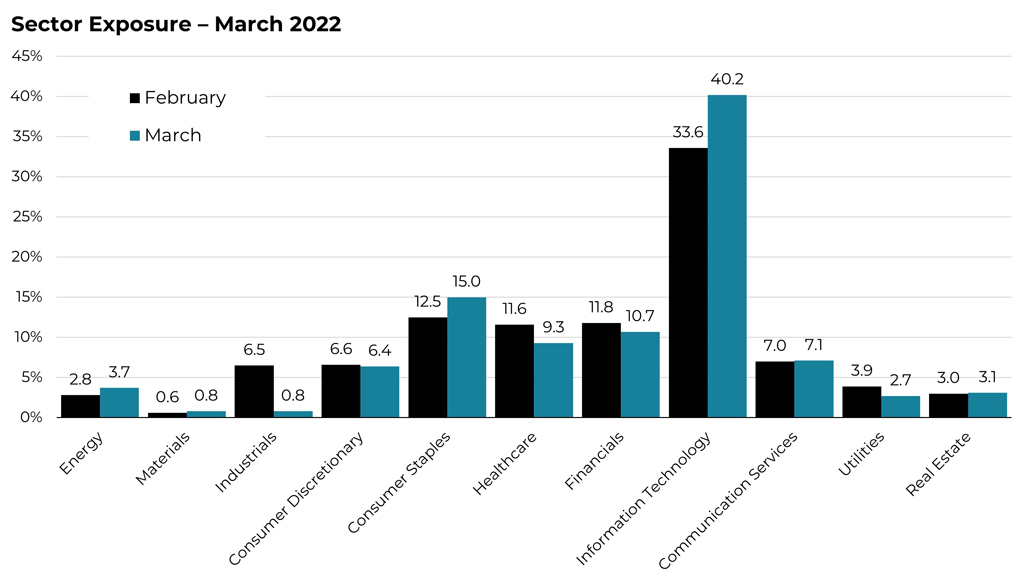

This Month: Largest % Increases

Energy and materials

This Month: Largest % Decreases

Industrials and utilities

Last Month: Best Performers

Energy and financials – like other ESG benchmarks, the strategy was negative in February, but the reduction in equity exposure generated a material improvement in return and risk versus the benchmark

Last Month: Worst Performers

Technology and consumer discretionary

Jump To Co-Founders' Note

Jump To: Asset Allocation

View Archive: ESG Summaries

Let's Talk

If you’d like to learn more about our risk-managed U.S. ESG Strategy