January 2022 ESG Summary For Risk-Managed ESG Strategy

Source: Blueprint Investment Partners

For illustrative purposes only. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

This Month: Asset Allocation

94% equities, which will be higher than December – despite a spike in volatility early in the month, equity exposure will increase due to continued strength in the individual stocks held in the portfolio, which will be spread across 69 stocks, with 6% allocated to fixed income and cash equivalents

This Month: Largest % Increases

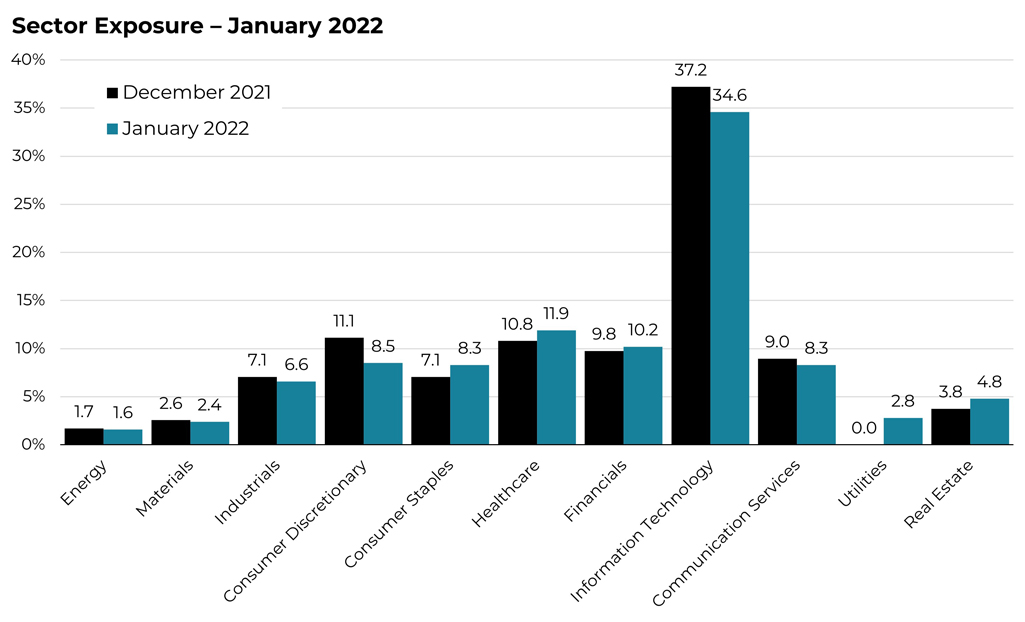

Real estate and consumer staples

This Month: Largest % Decreases

Tech and industrials

Last Month: Best Performers

Consumer staples and healthcare – with rising trends in U.S. equity markets persisting, the Strategy continues to benefit from its large-cap focused exposure

Last Month: Worst Performers

Consumer discretionary and energy

Jump To Co-Founders' Note

Jump To: Asset Allocation

View Archive: ESG Summaries

Let's Talk

If you’d like to learn more about our risk-managed U.S. ESG Strategy