How to Win The Communication Battle

September 30, 2021

Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.

—Sun Tzu

The world is changing. But isn’t it always? It’s always amazing to us how many in the investment world do not subscribe to a rules-based process that presupposes change. To us, this means employing a process based on time-tested principles without the use of predictions or emotion. We are far more interested in a repeatable process than being right on any random market call.

A little market volatility always seems to bring out the financial “experts” with their eulogies for the market. These predictions are just noise. But, it’s completely within the realm of human nature to fear an impending crisis when volatility increases, especially when coupled with negative economic/geopolitical headlines. The environment of the last 10-years has not helped with volatility, on average, running at historic lows.

In this Co-Founders’ Monthly Note, we discuss how financial advisors can win the communication battle by having a pre-determined investment plan. Knowing how you will react to changing market conditions and communicating that effectively to clients helps reduce emotional reactions spurred on by fear, especially now as volatility increases and markets decline. The idea is to protect against the “compound killers” and accept the noise in return. Since nobody has a crystal ball, the optimal approach in our view is to apply a predetermined, disciplined, rules-based approach to asset allocation.

But first, here’s a summary of our take on what transpired in the markets in September.

Asset-Level Overview: Market Talking Points for Financial Advisors

Equities & Real Estate

Stocks have started to show material weakness for the first time in 2021. At no point in the year thus far have downtrends been a real possibility for U.S. stocks, but the recent volatility has pushed some segments to the brink. While large caps remain the furthest from establishing downtrends, mid- and small-caps are in range. Likewise, value- and dividend-oriented indexes have either entered or are very near downtrends over shorter to intermediate timeframes.

Looking abroad, weakness has persisted, causing developed equities to join emerging markets in downtrends over the intermediate term. These asset classes seem poised to continue their longer-term shifts during the next 30 days, particularly emerging markets. If our exposure to international equities further decreases, it would result in an increasing concentration toward U.S. large caps via our single stock allocation process.

Although real estate’s performance in September was actually poorer than its equity counterparts, real estate securities largely remain entrenched in uptrends, for now. A repeat of this month in October, however, substantially increases the odds of intermediate-term downtrends. For now, we remain in our max allocation to this asset class.

Fixed Income & Alts

Fixed income’s previously upward course stalled in August and reversed entirely in September, resulting in more downtrends across all segments of this asset class. Longer duration U.S. Treasuries had established a long-term uptrend based on the previous climb, but this too is weakening. Even inflation-protected fixed income investments have been unable to hold uptrends in the intermediate timeframe. Considering the entrenched weakness of short duration fixed income instruments, the result will be a shift in our exposure away from fixed income of any meaningful duration and toward ultrashort duration notes and cash equivalents.

It would seem reasonable to suppose that the weakness in fixed income instruments and all the talk of inflation and instability might create an opportunity for alternatives like gold to excel. As we discussed in previous Monthly Notes, this continues to not be the case. In fact, at the time of this Note, gold is nearly the worst performer of the major asset classes we monitor for September. Hence, our allocation will remain at its minimum.

3 Potential Catalysts for Trend Changes: Giving Clients the Context

Slow(er) Growth: The Delta variant of COVID-19 appeared to temper economic growth this summer, but economists expect the recovery from the pandemic to reaccelerate as the virus’ toll eases. In recent weeks, many economists have lowered their forecasts for third quarter economic growth because consumers spending has slowed on meals out, hotels, and airline tickets.

More Taper Talk: The Federal Reserve signaled it was ready to start reversing its pandemic stimulus programs in November and could raise interest rates next year amid risks of a lengthier-than-anticipated jump in inflation. The Fed’s rate-setting committee indicated in its most recent post-meeting statement that it could start to reduce, or taper, its $120 billion in monthly asset purchases as soon as its next scheduled meeting, Nov. 2-3. Federal Reserve Chairman Jerome Powell said officials hadn’t made a formal decision on how quickly to reduce purchases, but most indicated that a gradual process, “that concludes around the middle of next year is likely to be appropriate.”

When the Check Comes: Treasury Secretary Janet Yellen told Congress that the Treasury would be unable to pay all the government’s bills if lawmakers don’t raise or suspend the federal borrowing limit by Oct. 18. The letter from Yellen makes clear that lawmakers have a narrow window in which to approve a debt limit increase or suspension before the Treasury could begin to miss payments on its obligations, triggering a default that could shake markets.

Hello, It’s Been A While…

Those who cannot remember the past are condemned to repeat it.

—George Santayana

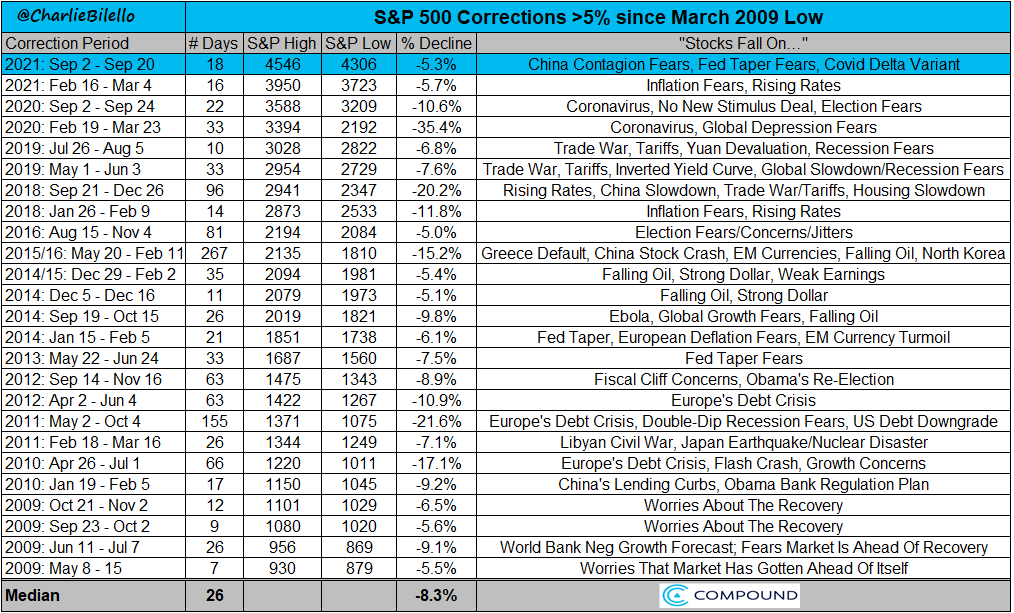

Because it’s been a while since the S&P 500 declined by 5% (March 2021) or greater (November 2020), investors could perhaps be forgiven for forgetting what volatility feels like. Forgiveness notwithstanding, September in general and more specifically the Evergrande meltdown brought a reminder of how fast sentiment can change. After two positive days to open the month, the S&P 500 Index experienced 10 losing days out of the next 12, falling 5.4%.

Source: compoundadvisors.com/2021/7-chart-sunday-9-26-21

Interestingly, the effects of volatility seem almost more a product of the environment they directly follow than of volatility itself. In other words, it is not volatility that scares people but the rate of change in volatility. For example, this same level of volatility in April 2020 after the Coronacrash would have drawn less response as investors acclimated to the new regime. However, newly developed volatility following six months of steadily increasing prices produces a visceral response.

While the timing of the volatility spike might have been unpredictable, the reaction to it among our partnering advisor’s clients was not. For the first time since the Coronacrash, we started hearing from advisors about clients calling and fretting about their accounts. Should we reduce exposure to international markets or increase cash? Is Evergrande the next Lehman Brothers? These are the types of questions our advisors have been receiving.

Tempering the Uncertainty in International Stocks With Process & Communication

We often talk about the importance of process and communication – both for us as well as our partnering advisors. September’s action is another great example of this. From a process perspective, our attention to market prices (rather than predictions) meant we were proactively shifting our portfolios away from emerging markets ahead of the media frenzy around the Evergrande news. At the end of July, our portfolios reduced exposure to emerging markets by as much as 40%. In terms of communication, always having a plan via disciplined processes allows us to communicate what is happening and what advisors can expect.

We say it often, but let us reiterate it once again. In the face of inherent uncertainty in the markets, advisors can generate substantial competitive advantages by creating certainty in areas where they exercise control. Investment processes via systematic allocation shifts and communication are two such areas.

Toward that end, here are some real-time talking points advisors utilizing our strategies can use with their clients:

Looking ahead, should international trends continue deteriorating, we will methodically reallocate toward stronger U.S. equity segments should conditions remain stable. This regimented handoff process will not only reduce risk but also take advantage of opportunities through our single stock process in eligible accounts or via our funds. Lately, reducing risk and taking opportunities has meant shifting exposure from sectors like industrials and materials toward technology and healthcare.

In fixed income, we will continue retreating from weaker segments of the yield curve or weaker geographic regions, while moving toward areas that are doing a better job of protecting capital. Said another way, we will continue to set aside our egos and listen to what the market data is telling us. Whether it is a market insider, member of the Fed, or member of Congress, someone always seems to know, and price usually reflects that knowledge.

In closing, we want our partnering advisors and their clients to feel confident in the plans they have made and that we are helping to execute. Spikes in volatility are disconcerting, particularly when they follow periods of quiet. Yes, this can cause clients to reach out and ask questions but if that cements relationships and shores up areas of concern then it represents an opportunity for advisors (and Blueprint Investment Partners) to shine.

Let's Talk

If you’d like to learn more about Blueprint's repeatable and disciplined application of a systematic investing process