Why Predictions are More Dangerous

I was always terrible at those “guess how many tootsie rolls are in the jar” games as a kid. My complete lack of skill never deterred me from participating though. I mean, what kid was going to pass up the opportunity for a windfall like that?! Plus, it was just a guess. None of my…

Read MoreThe Investing Equivalent Of Parachute Pants

If you search deep in the nooks and crannies of your memory, you probably can recall one specific fashion choice you made in your younger days that you now look back on with absolute shame. You may have destroyed the pictures – I know I did, and thank goodness this was before the digital age!…

Read MoreMarket Predictions Are (Still) Trash

Since Blueprint Investment Partners is an asset manager, financial services dogma says that right now I’m supposed to tell you where the S&P will close in 2022, which asset class will be the top performer, and where Treasuries are headed. Instead, for two good reasons I’m going to highlight some laughable predictions made by market…

Read MoreSurvey Says Sell Discipline Sucks

The last time an asset manager told you about their buy/sell process, did the conversation sound a lot like what’s depicted in this pie chart? It’s bewildering, considering building and maintaining an investment portfolio requires decisions about what to buy and sell. Yet, even elite institutional portfolio managers disproportionately focus on the first half of…

Read MoreIs it Human Nature To Distrust Simplicity?

A colleague recently shared a blog that in essence questioned why quantitative investment strategies, and specifically trend following, was not more widely embraced by the investment management industry. It was a compelling question that prompted me to consider a larger one: Is it human nature to distrust simplicity? The Blueprint Investment Partners team bantered back…

Read MoreBubbles: Are We In One and Does It Even Matter?

Perhaps the most striking characteristic of economic bubbles – which is also what fuels their very existence – is our blindness to them. Historically, few have correctly called a bubble in advance. And yet, in modern times, people have been asking if we’re in the bubble since 2010. What gives? An Implausible Gap Between Price…

Read More2021 Market Predictions are Trash

A colleague recently shared with me a story about a January tradition of the Kiwanis Club of Cape Fear in Fayetteville, NC, which holds a contest to see who can best predict where the Dow Jones Industrial Average will end the year. She described how some members have a thoughtful internal debate while others jot…

Read MoreThe Sweet Spot Between Robo-Advice & The Dinosaurs

It took some painful contortions in the markets this year for many financial advisors to realize robo-advisors may not be as diversified and risk-managed as they claim. At Blueprint Investment Partners, we believe there is a “sweet spot” between the rudimentary machinations of a robo-advisor and a more traditional asset allocation method. In fact, we’ve…

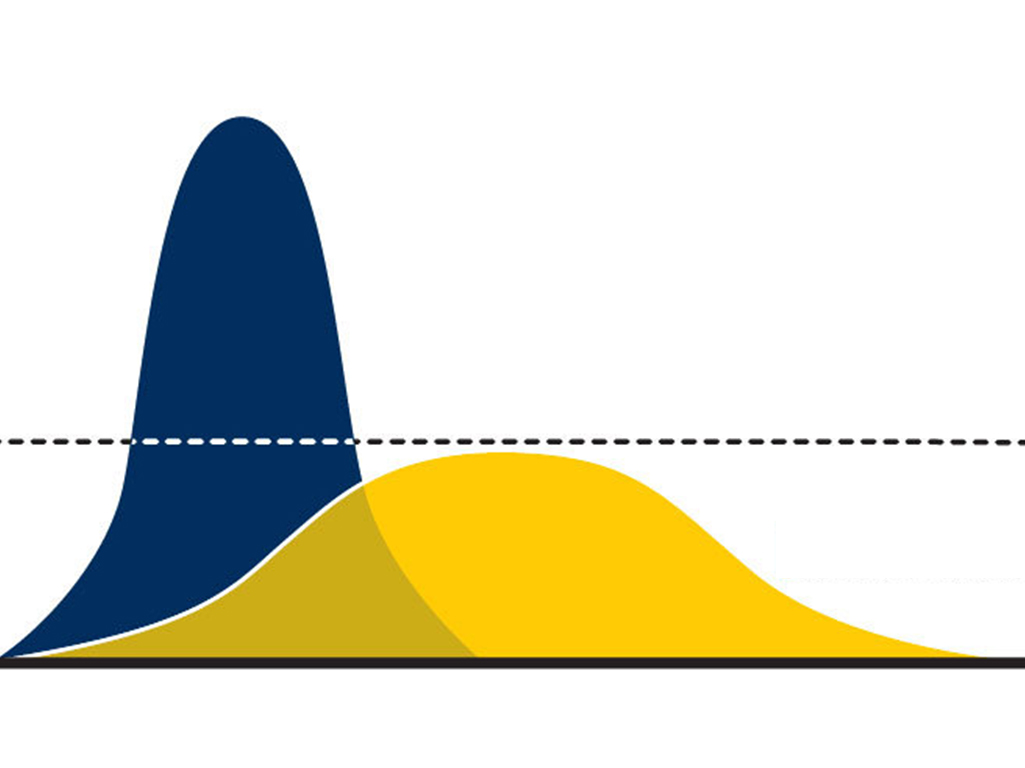

Read MoreFinancial Advisors Can Flatten the Emotion Curve

What incredible times we are living through right now. About six weeks ago, here in the U.S. all seemed quiet and strong. Of course, there are always problems, but by comparison to today, things were positive. Boy, that seems like a long time ago. Regardless of how this coronavirus pandemic plays out, a lesson we…

Read MoreForecast: Unpredictability With a Chance of Irrational Behavior

Blueprint Investment Partners hosted a behavioral finance webinar last week with our friend Jay Mooreland, author of “The Emotional Investor.” The event motivated me to re-read his book, which I highly recommend. It also reminded me of the investment industry’s annual prediction cycle about what to expect for the coming year and how the market…

Read More