Webinar Highlights: The Next Generation of Liquid Alts

As the head of Blueprint Investment Partners, I had a unique opportunity to moderate a virtual panel discussion with three of the biggest names in the liquid alternatives space last month: Bob Elliott, Corey Hoffstein, and Jerry Parker. I was energized by what I saw and heard, as well as inspired to share some video…

Read MoreTilting the Index In Your Favor

“Good Ideas Can’t Be Scheduled” is the title of a 2019 blog post by Morgan Housel of Collaborative Fund. His point was that deadlines shouldn’t be placed on good ideas, regardless of field, but the execution of good ideas is the opposite. One of Blueprint Investment Partners’ best “good ideas” presented itself just like that…

Read MoreWhat Does A Next-Generation Liquid Alt Look Like?

As a kid who played whatever sport was in season, when the weather didn’t cooperate, I brought that passion inside to the latest sports video game. It was routine for me to battle my friends in games such as Madden NFL, NBA 2K, MLB The Show, and FIFA. Even the NHL made an appearance from…

Read MoreDid Your Retirement Bucket Spring a Leak in 2022?

Not 2008, not the early 1980s, but 2022 was the worst year for bonds on record, according to an analysis by investment historian Edward McQuarrie. That’s more than a headline for financial advisors who have relied on fixed income as the less-volatile portion of their 70/30 or 60/40 portfolios – especially for their retirement-age clients.…

Read MoreCan Retirement Income Be Modernized? A Guide for Financial Advisors.

Just one of these scenarios likely would be enough to cause concern for an investor: Yet in 2022, we’re facing all three at once. It’s a potentially catastrophic combination, especially for investors nearing or in the early years of retirement. In my opinion, this is a “perfect storm” (yes, I know that’s a super cliché…

Read MoreCourage is Not the Absence of Fear In Mountaineering (Investing Too!)

A friend recently convinced me to watch a new(ish) Netflix documentary, “14 Peaks: Nothing is Impossible.” It follows a Nepalese mountaineer who attempts to climb all 14 of the world’s peaks higher than 8,000 meters in less than seven months. Even a non-climber like me can appreciate that the endeavor undertaken by the film’s star,…

Read MoreYou Know Who’s Terrible in a Crisis? A Robot.

Call me a luddite if you like, but few things annoy me as much as when I navigate to a new webpage and that, “How can I help you?” box pops up on the lower right. That chatbot entering uninvited always sends me on a frantic search for how to make it disappear as quickly…

Read MoreIs Planning Alpha Greater than Investment Alpha?

How does that saying go? Something about how the more things change, the more they stay the same? Within financial advisory practices, this sentiment rings abundantly true in the area of portfolio construction/management. So much has changed in the past few years. For one, the pandemic altered how investors interact with their advisors. Potentially more…

Read MoreSurvey Says Sell Discipline Sucks

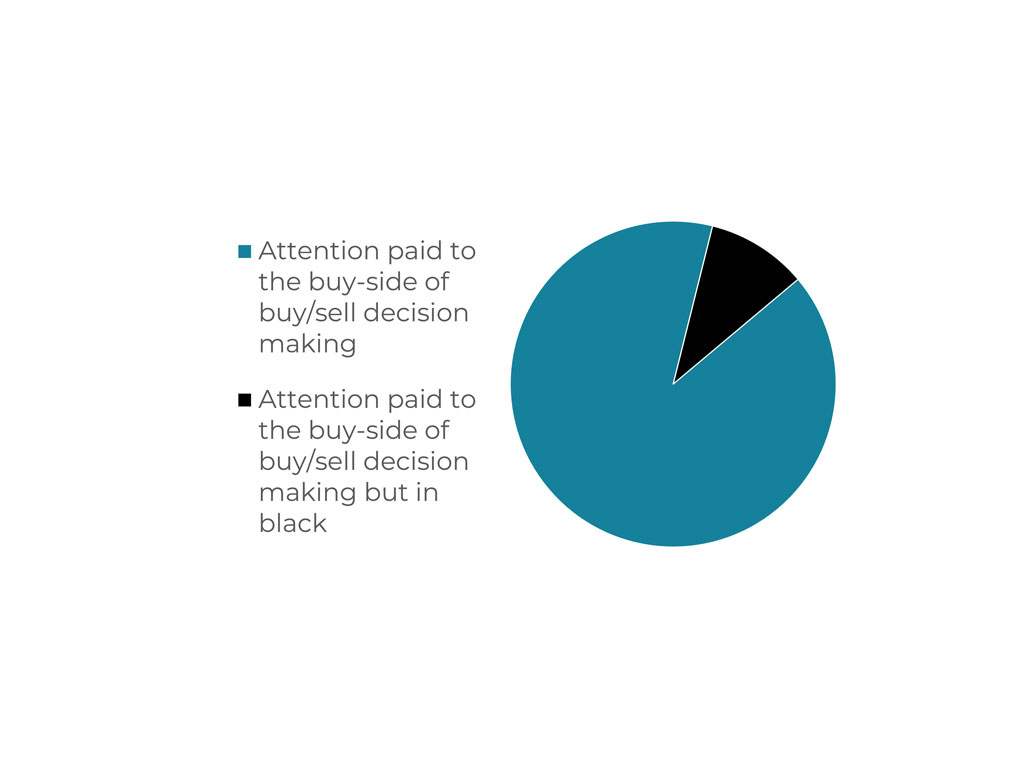

The last time an asset manager told you about their buy/sell process, did the conversation sound a lot like what’s depicted in this pie chart? It’s bewildering, considering building and maintaining an investment portfolio requires decisions about what to buy and sell. Yet, even elite institutional portfolio managers disproportionately focus on the first half of…

Read MoreDo Asset Manager Biases Cannibalize Existing, Still Viable Holdings?

We’re able to better understand the scale of the problem associated with neglect of selling discipline among institutional asset managers thanks to a study released earlier this year, “Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors.” The research by Klakow Akepanidtaworn, Rick Di Mascio, Alex Imas, and Lawrence Schmidt took the…

Read More