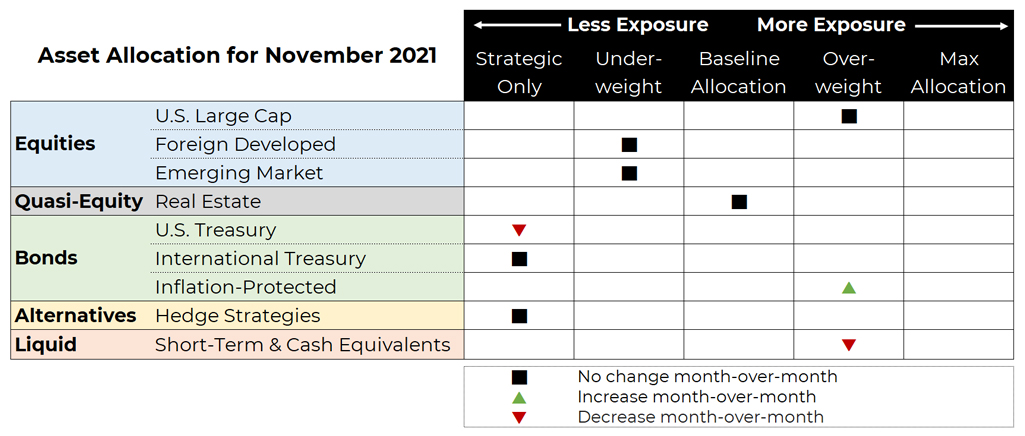

November 2021 Asset Allocation Update For Risk-Managed Portfolios

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Exposure will remain constant. Intermediate-term downtrends are dancing around the point of flipping to uptrends, but both foreign developed and emerging market asset classes continue to be significantly weaker than their U.S. counterparts.

Real Estate

Exposure is at its baseline allocation, and there are uptrends in both timeframes.

U.S. & International Treasuries

Exposure will decrease to its minimum allocation, as long duration bonds in the U.S. enter downtrends over the intermediate timeframe. All other duration segments have continued downtrends across all timeframes.

Inflation-Protected Bonds

Exposure will increase to overweight, as the intermediate-term uptrend reforms and the long-term trend remains up.

Alternatives

Exposure will not change due to continued downtrends in gold.

Short-Term Fixed Income

Exposure will decrease by returning some of the previous allocation to inflation-protected bonds.

Jump To Co-Founders' Note

Asset Allocation CEO Update

Jump To: ESG Strategy Summary

View Archive: Asset Allocation Updates

Let's Talk

If you'd like additional details about current asset allocation for a particular risk-managed strategy