August 2022 ESG Summary For Risk-Managed ESG Strategy

Source: Blueprint Investment Partners

For illustrative purposes only. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

This Month: Asset Allocation

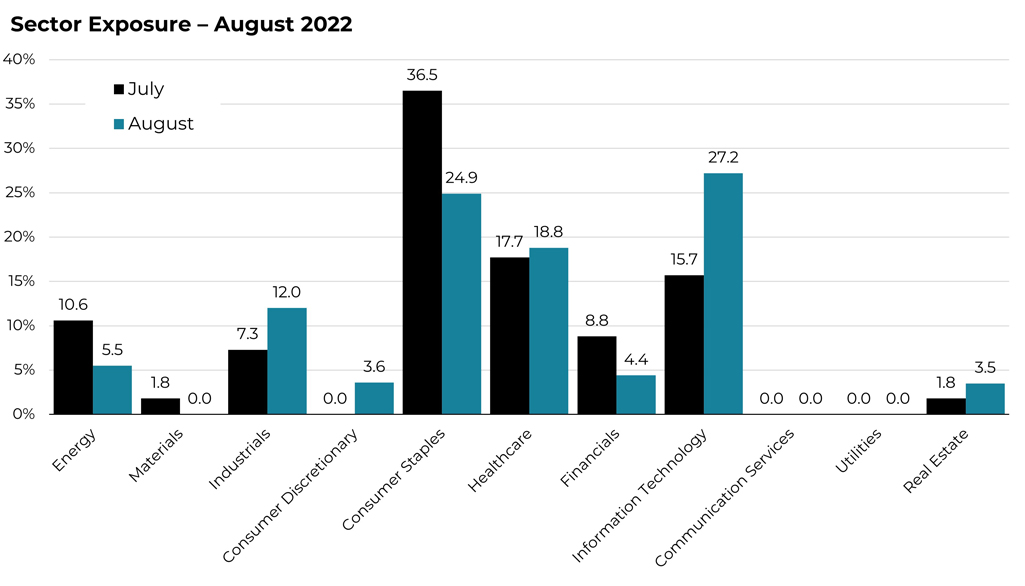

32% equities (spread across 31 stocks), which will be higher than July as the Strategy experiences its first increase in equity exposure in several months due to strong intermediate-term performance, specifically within the technology sector –68% will be allocated to fixed income and cash equivalents

This Month: Largest % Increases

Consumer discretionary and real estate – the portfolio continues to maintain a tilt toward value-oriented sectors, though the exposure shifts occurring for August will push the portfolio closer to a more neutral positioning between growth and value

This Month: Largest % Decreases

Materials and financials

Last Month: Best Performers

Consumer discretionary and technology

Last Month: Worst Performers

Utilities and healthcare

Jump To Co-Founders' Note

Jump To: Asset Allocation

View Archive: ESG Summaries

Let's Talk

If you’d like to learn more about our risk-managed U.S. ESG Strategy