Risk-Managed ESG Strategy Launched by Blueprint Investment Partners

April 1, 2019

Blueprint Investment Partners, an asset manager and pioneer in the creation of systematic, process-driven, and transparent investment strategies for financial advisors, announced today the launch of the Blueprint U.S. ESG Strategy. The Strategy offers a diversified portfolio of companies with positive environmental, social, and governance (ESG) attributes, wrapped in a systematic risk-managed framework.

“In our view, a major problem with investing – especially ESG investing – is that too many investors feel they must choose between staying true to their personal values and achieving their long-term investment goals,” says CEO and Co-Founder Jon Robinson. “How do you bridge those two objectives? We believe the answer is to use a systematic, disciplined, and risk-managed process. And that’s exactly what we’ve done with the Blueprint U.S. ESG Strategy.”

The Strategy is diversified among large- and mid-cap companies selected from across sectors so long as they exhibit positive ESG attributes. The portfolio is wrapped in the Blueprint Investment Partners systematic, risk-managed investing process, which dynamically adjusts the holdings on a monthly basis.

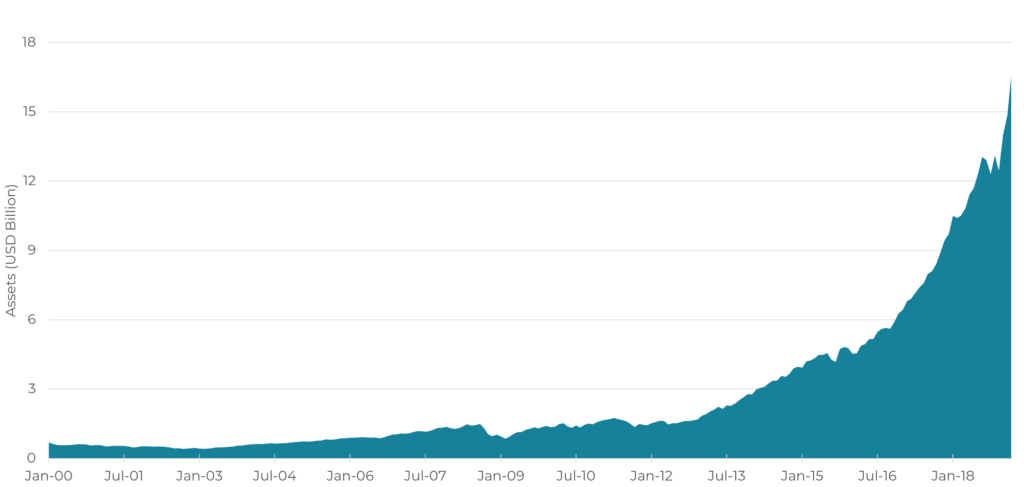

U.S. sustainable fund AUM has increased dramatically since 2000, growing 17.94% compounded.

Sustainable Fund Asset Growth in the United States Since 2000

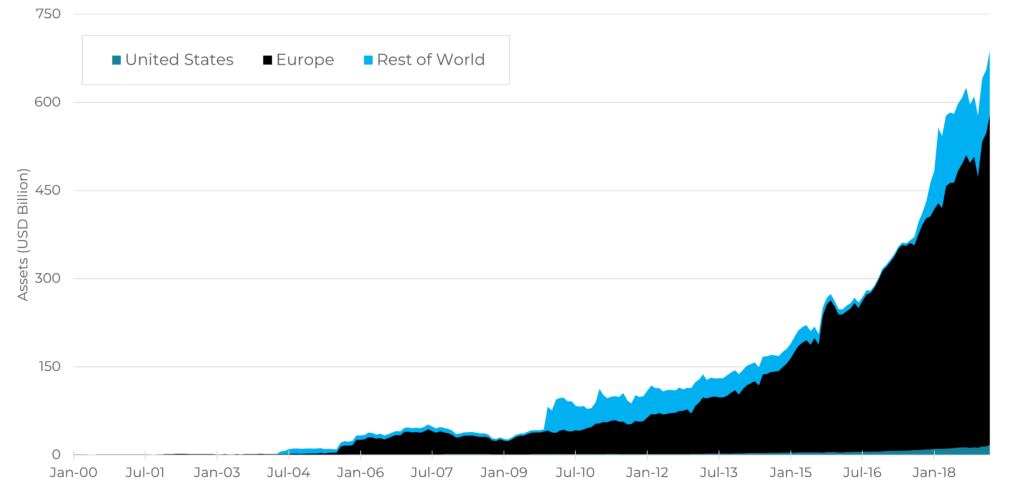

However, the domestic sustainable investing movement is young compared to adoption in other parts of the world. If the U.S. continues growing at about 18% CAGR, it will take almost 22 years to surpass the current level of ESG assets in Europe.

Sustainable Fund Asset Growth by Region Since 2000

“We see this growth potential as an opportunity for financial advisors to differentiate their practices with a disciplined ESG offering,” adds Robinson. “As for the Blueprint U.S. ESG Strategy, it would be particularly compelling for clients who want downside protection, prefer values-based investing, understand the importance of risk management when working toward long-term financial goals, expect their portfolio to do more than simply track annual market performance, and are tax sensitive.”

About Blueprint Investment Partners

Blueprint Investment Partners is an asset manager and pioneer in the creation of systematic, process-driven, and transparent investment strategies for financial advisors and institutions. The firm was founded on a management philosophy honed by its co-founders during the 2008 financial crisis. Blueprint Investment Partners applies a rules-based approach to both asset class and time diversification, instilling discipline and removing human bias during emotionally charged market environments. The firm offers a suite of distinct global investment portfolios that are distinguished by their risk tolerance or ESG objectives, with the models delivered as separately managed account strategies.