Protecting the Financial Advisor’s Blind Side

The 2021 NFL Draft, which begins tomorrow, is expected to highlight more than ever that quarterback is arguably the most important position in all sports. If we stick to football and assume QB is indeed the most important role, what is second? Many cases can be made, but if money talks, then shouldn’t the answer…

Read MoreFlows Before Pros

This is not another article about Reddit, robos, and Robinhood. Well actually, it a little bit is. But hear me out: We’ll be light on the pontification (you don’t need a 4,000th article on GameStop) but heavy on the conundrum financial advisors face and the trump card held by providers of financial advice. Adaptation or…

Read MoreBubbles: Are We In One and Does It Even Matter?

Perhaps the most striking characteristic of economic bubbles – which is also what fuels their very existence – is our blindness to them. Historically, few have correctly called a bubble in advance. And yet, in modern times, people have been asking if we’re in the bubble since 2010. What gives? An Implausible Gap Between Price…

Read More2021 Market Predictions are Trash

A colleague recently shared with me a story about a January tradition of the Kiwanis Club of Cape Fear in Fayetteville, NC, which holds a contest to see who can best predict where the Dow Jones Industrial Average will end the year. She described how some members have a thoughtful internal debate while others jot…

Read MoreESG Investing: Driven by Risk Management & Client Demand (Part 2)

There’s been a paradigm shift in our recent conversations with financial advisors about ESG investing. Whereas ESG investors previously were thought by some to be anti-capitalist tree huggers, this silly trope has run its course. Instead, there is a realization that optimal management of resources, social equity, and ethical corporate administration can significantly benefit human…

Read MoreYou Can’t Win a Tournament in Round 1, But You Sure Can Lose It

Haters who know I bleed “Carolina Blue” will accuse me of taking a cheap shot with the story I’m about to retell. But when the world of sports rivalries intersects with managing risk in an investment portfolio, it seems unreasonable to ask me to not make the following comparison! The year was 2012. The team…

Read MoreThe New 20-Year Stock Chart

The last 20 years have given us three major market shocks. These resulted from the end of a tech bubble, a financial crisis and now, a global pandemic. During this time, investors have experienced numerous emotional highs and lows, yet in general, the approach to investing delivered by the financial services industry has not fundamentally…

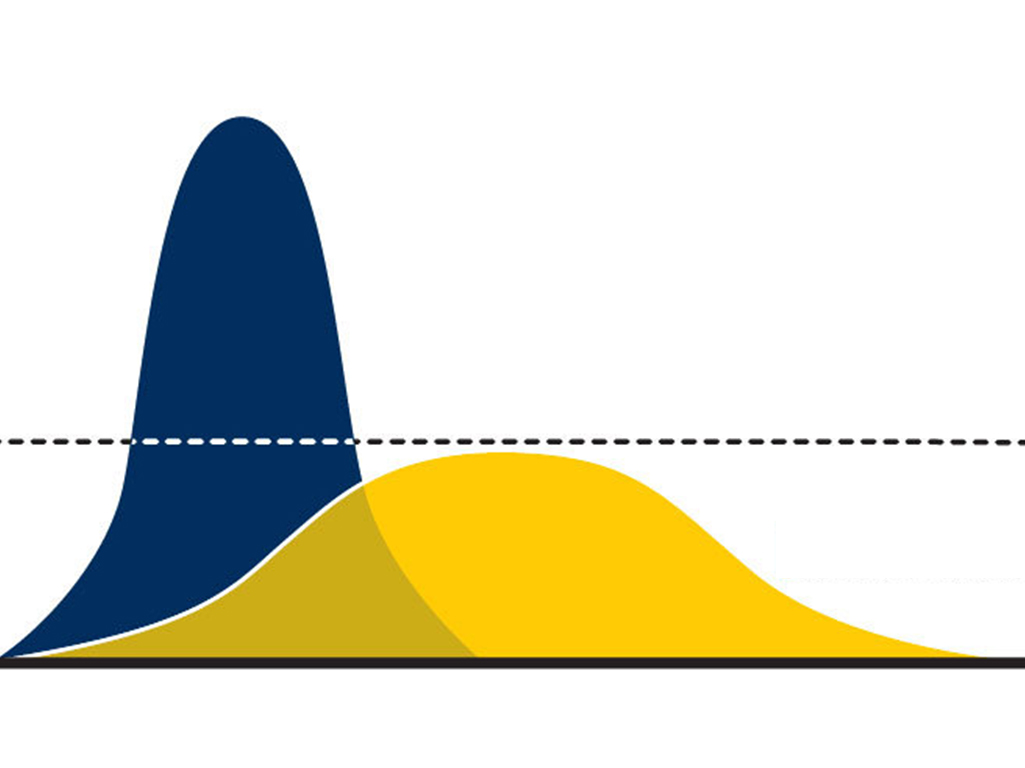

Read MoreFinancial Advisors Can Flatten the Emotion Curve

What incredible times we are living through right now. About six weeks ago, here in the U.S. all seemed quiet and strong. Of course, there are always problems, but by comparison to today, things were positive. Boy, that seems like a long time ago. Regardless of how this coronavirus pandemic plays out, a lesson we…

Read MoreFinding Clarity Amid Confusion

By most measures, markets have entered a bear phase and are down almost 20% from all-time highs. The coronavirus, oil rout, and politics have combined to create a perfect storm in the markets. In times like these, what do we crave most? Surely, we all want to be safe and to know that the virus…

Read More