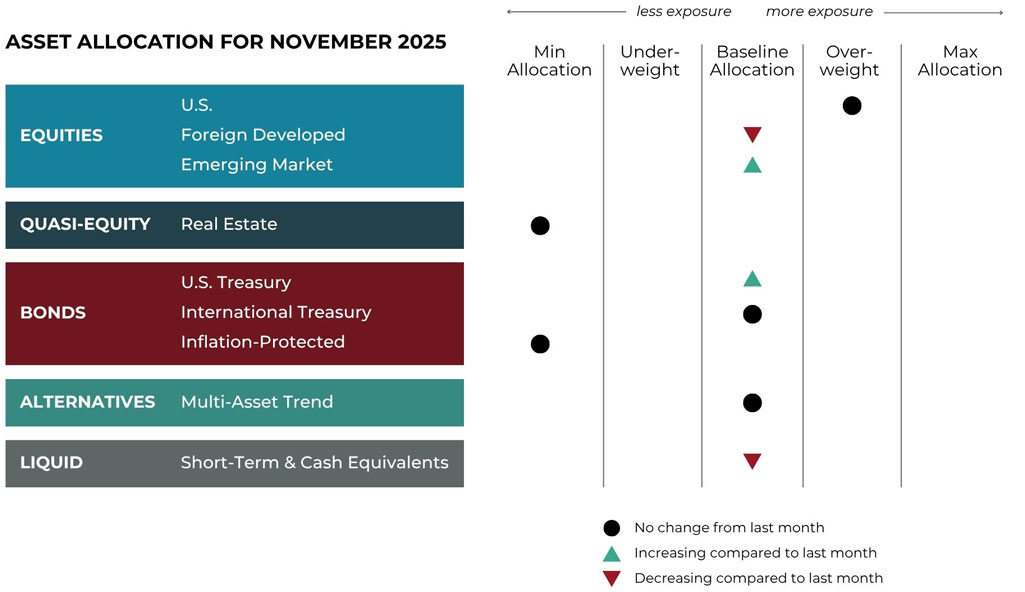

November 2025 Asset Allocation Update For Risk-Managed Portfolios

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Overall exposure will not change, with both foreign developed and emerging market equities coming into baseline allocation. Trends continue to be positive across all timeframes, and foreign developed will handoff some exposure back to strengthening emerging markets.

Real Estate

Exposure will not change and remain at its minimum.

U.S. & International Treasuries

U.S. exposure will increase and move to baseline. Trends in the middle part of the U.S. Treasury yield curve are strongest and are now positive across all duration lengths. International Treasuries have weakened but are maintaining uptrends, and their overall allocation will remain at baseline.

Inflation-Protected Bonds

Exposure will be at its minimum. Trends are still positive but the group remains weak versus other fixed income assets.

Alternatives

Exposure is expressed through a multi-asset alternative ETF. Bond exposure remains the largest allocation, with net long exposure increasing during the month. Stocks remain the second-largest net allocation (long). Commodity exposure is net short, with longs in metals and shorts in grains keeping overall exposure balanced.

Short-Term Fixed Income

Exposure will decrease as some allocation is handed back to stronger U.S. Treasuries.

Jump To Co-Founders' Note

Jump To: S&P 100 Strategy Summary

View Archive: Asset Allocation Updates

Let's Talk

If you'd like additional details about current asset allocation for a particular risk-managed strategy