May 2024 Asset Allocation Update For Risk-Managed Portfolios

Source: Blueprint Investment Partners

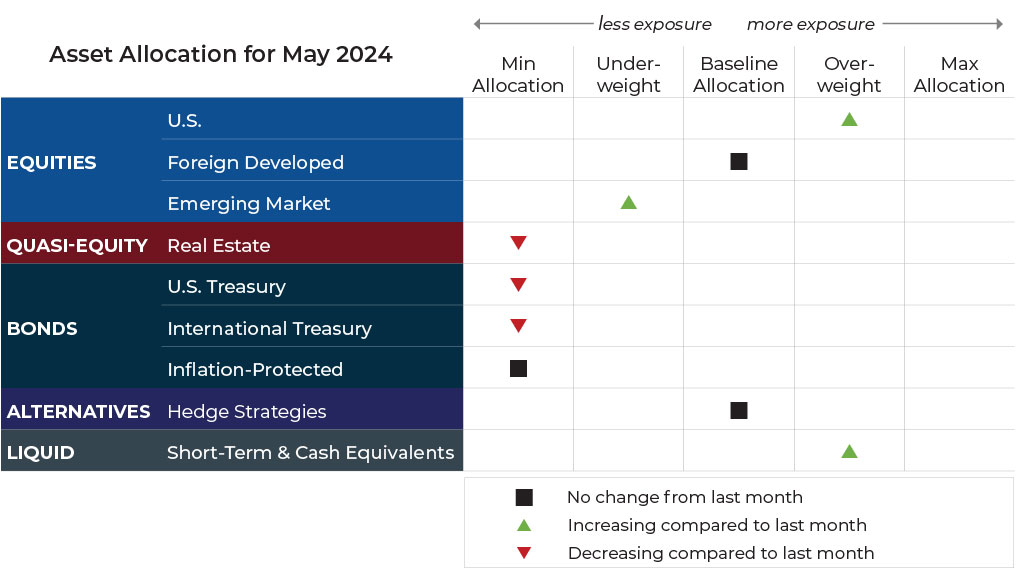

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Exposure will increase slightly and remain underweight overall. Trends are positive across all timeframes and while still weaker than its U.S. counterparts, emerging markets have strengthened enough to warrant a higher allocation as we enter May.

Real Estate

Exposure will decrease to its minimum allocation as trends across both timeframes turn negative.

U.S. & International Treasuries

Exposure will decrease to its minimum allocation as the long-term trend joins the intermediate term in negative territory.

Inflation-Protected Bonds

Exposure will not change and remains at its minimum due to downtrends across both timeframes.

Alternatives

Exposure will not change and remains at baseline, which is also our maximum limit for this asset class. Uptrends persist across both timeframes for gold.

Short-Term Fixed Income

Exposure will increase as it takes on exposure from weaker fixed income instruments.

Jump To Co-Founders' Note

Originally published 4/30/2024. Updated 5/6/2024.

Jump To: ESG Strategy Summary

View Archive: Asset Allocation Updates

Let's Talk

If you'd like additional details about current asset allocation for a particular risk-managed strategy