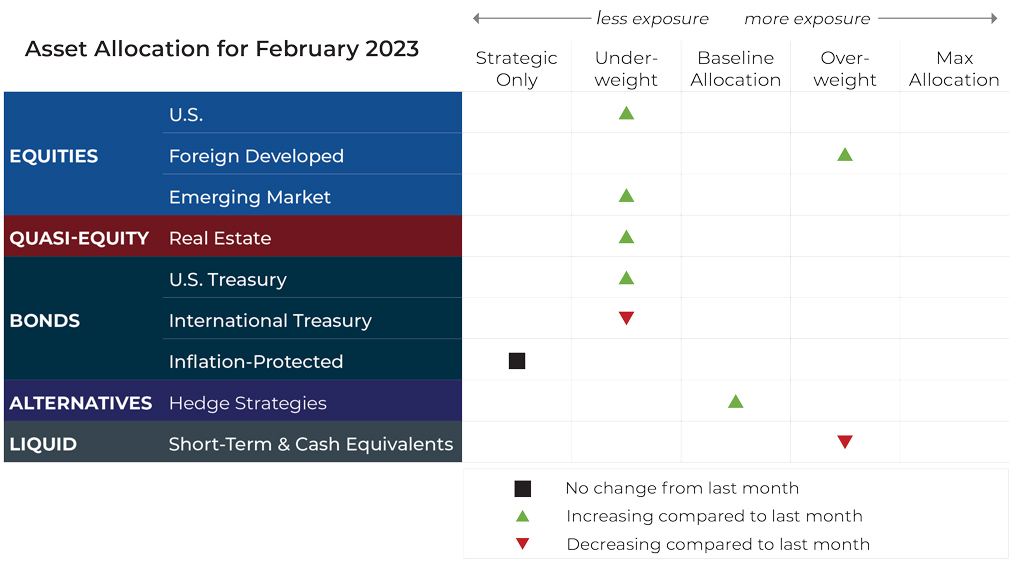

February 2023 Asset Allocation Update For Risk-Managed Portfolios

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Exposure will increase, as both foreign developed and emerging market equities strengthen. Foreign developed equities now have uptrends across both timeframes, while emerging markets have an intermediate-term uptrend coupled with a long-term downtrend.

Real Estate

Exposure will increase from its minimum allocation, as the intermediate-term timeframe moves into an uptrend. The long-term trend remains negative.

U.S. & International Treasuries

Exposure will increase, as U.S. Treasuries join their international counterparts with an intermediate-term uptrend. The long-term trends remain negative.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Alternatives

Exposure will increase, as gold produced a long-term uptrend to join the pre-existing intermediate-term uptrend.

Short-Term Fixed Income

Exposure will decrease, as allocation returns to strengthening assets such as U.S. and international equities, as well as fixed income and gold.

Jump To Co-Founders' Note

Asset Allocation CEO Update

Jump To: ESG Strategy Summary

View Archive: Asset Allocation Updates

Let's Talk

If you'd like additional details about current asset allocation for a particular risk-managed strategy