A Risk-Managed ETF That Dynamically Adjusts Global Asset Allocations

If markets are in a “business as usual” mode, ClearShares OCIO ETF exposures will look similar to other global investment portfolios.

But, when unique market conditions arise, the systematic investing process automatically adjusts asset allocations.

An All-Weather Portfolio

Here’s what this dynamic process can look like during four common market environments:

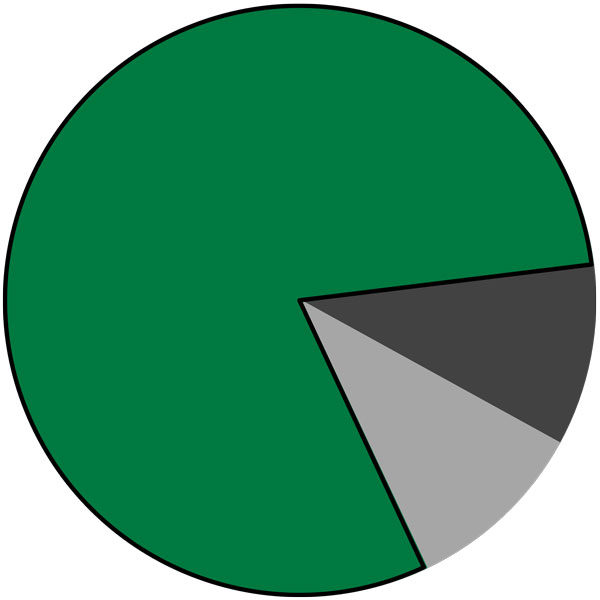

Usual Market: Stocks Rising & Volatility Low

Looks like a traditional growth model, with heavy exposure to global equities

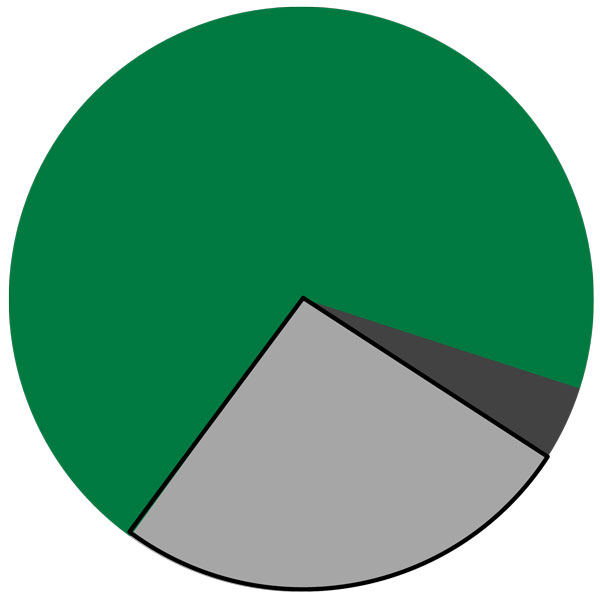

Inflationary/Rising Rate Environment

Greater emphasis on inflation hedges

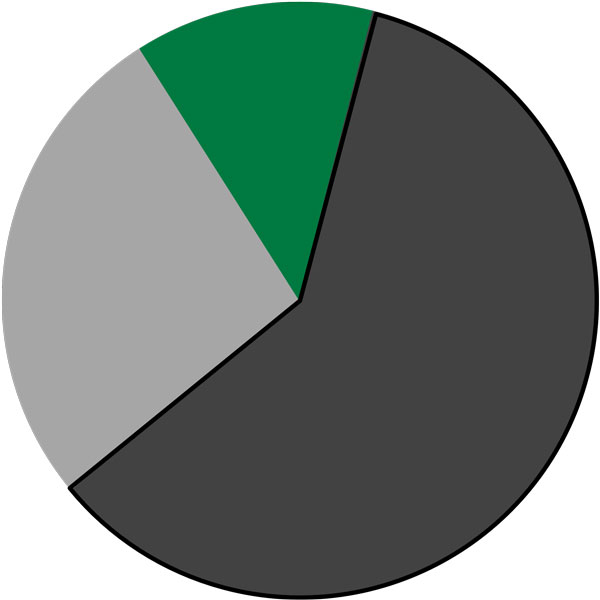

Equities Falling & Volatility Increasing

Significant exposure to domestic & international Treasury bonds

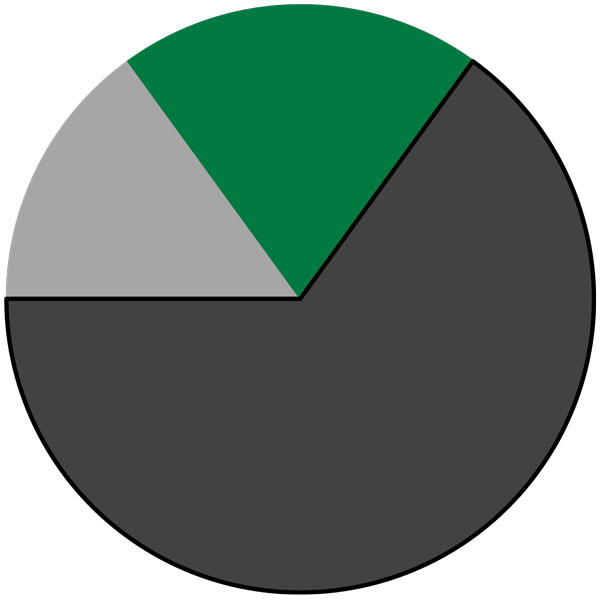

Equities & Bonds Falling

Focused in short-duration fixed income & cash equivalent instruments

This adaptive approach helps financial advisors manage risk regardless of the market environment.

5 Primary Attributes OCIO ETF

Global Asset Allocation

Portfolio diversification across seven major global asset classes in a single ETF

Rules-Based Process Optimized for Behavioral Finance

Systematic investing process that we believe answers all questions about what, when, and how much to buy and sell –repeatable rules that maintain discipline during prolonged market volatility by leaving no room for emotional decision-making amidst euphoria or fear

Dynamic Adjustments in Response to Market Changes

Asset allocation naturally adapts to market conditions – portfolio can look quite different depending on the environment (e.g., when there are uptrends/downtrends in an asset class, interest rates change, volatility arises, or inflation/deflation occurs)

Focus on Managing Downside Risk

Constructed to manage risk during bear markets and periods of severe drawdowns (like 2022 and the Coronacrash of March 2020), but doesn’t need to go completely “risk off” amidst less significant pullbacks (especially those that affect only select asset classes, not the whole financial system)

Tax-Aware Portfolio Management

Within the ETF wrapper, decision making is diversified across a blend of timeframes, which generally allows short-term losses to be harvested and gains to be held as long as uptrends persist

Let's Talk

Please reach out you’d like to learn more about OCIO

Roots of Systematic Investing Process Date Back to 2013

Blueprint Investment Partners began sub-advising OCIO in October 2021, but OCIO uses the same systematic investing process used to manage Blueprint’s separately managed account strategies since January 2013.

Blueprint Investment Partners claims compliance with the Global Investment Performance Standards (GIPS®) and has been independently verified for the period of January 1, 2013, through December 31, 2021.

Let's Talk

If you’d like to learn more about OCIO, a risk-managed, global asset allocation ETF